- AiartGallerie(Invest)'s Newsletter

- Posts

- ➡️ 4 Sectors Advances by STMicroelectronics You Need to Know

➡️ 4 Sectors Advances by STMicroelectronics You Need to Know

In today’s hyper-connected world, semiconductors are the backbone of virtually every electronic device, from the smartphones in our pockets to the complex systems driving modern vehicles. Semiconductors, often referred to as the "brains" of electronics, play an indispensable role in processing data, powering communications, and enabling the smart technologies that define our daily lives.

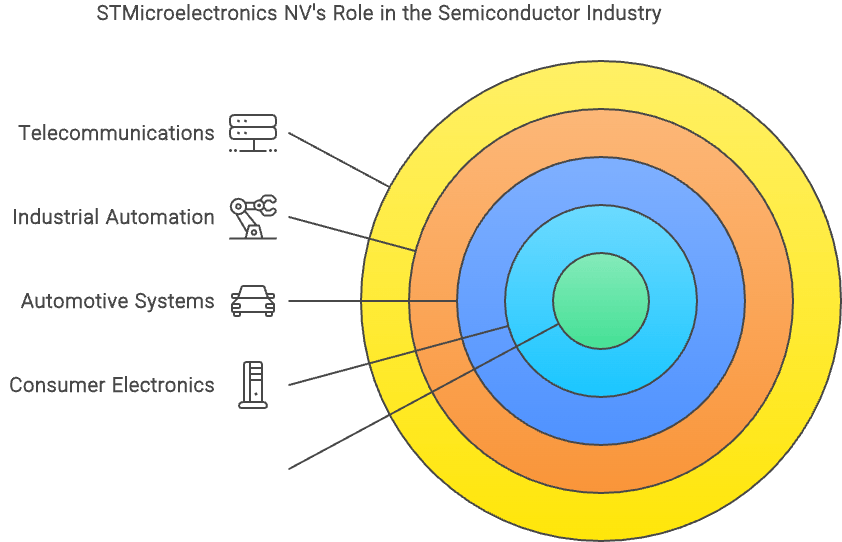

The semiconductor industry serves a wide array of sectors:

Consumer Electronics: From smartphones and laptops to smart home devices, semiconductors are essential for powering these gadgets. The demand for faster, smaller, and more energy-efficient chips continues to drive innovation in this segment.

Automotive Systems: As vehicles become more intelligent and connected, the demand for semiconductors in automotive applications has surged. Semiconductors are key to advanced driver-assistance systems (ADAS), electric vehicles (EVs), infotainment systems, and more.

Industrial Automation: In the era of Industry 4.0, semiconductors are critical for automating manufacturing processes, improving efficiency, and enabling the smart factories of the future.

Telecommunications: The rollout of 5G networks has escalated the need for high-performance semiconductors that can handle increased data traffic and enhance connectivity.

The semiconductor industry is characterized by rapid technological advancements, requiring significant capital investments in research and development (R&D). Additionally, it is known for its cyclical demand patterns, influenced by factors such as consumer electronics cycles, economic conditions, and technological shifts.

Key Industry Trends

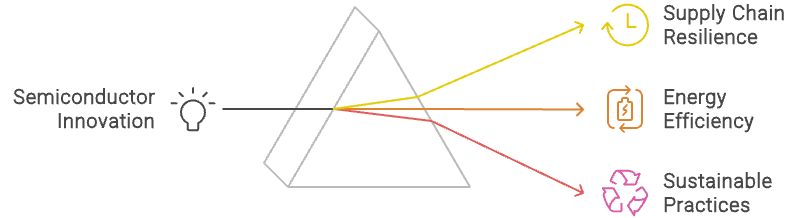

A. Technological Innovation

Technological innovation is at the heart of the semiconductor industry’s growth. The rise of artificial intelligence (AI), the Internet of Things (IoT), and the deployment of 5G networks are creating unprecedented demand for advanced semiconductors. AI and machine learning algorithms require powerful chips capable of processing vast amounts of data in real-time. IoT devices, from smart thermostats to industrial sensors, rely on semiconductors for connectivity and data processing. Meanwhile, 5G networks are driving the need for semiconductors that can support higher speeds, lower latency, and greater connectivity.

B. Supply Chain Dynamics

The semiconductor supply chain is among the most complex and globalized of any industry. It involves multiple stages, including design, fabrication, testing, and packaging, often spread across different countries. Recent years have highlighted the fragility of this supply chain, with disruptions caused by geopolitical tensions, natural disasters, and the COVID-19 pandemic. These challenges have prompted a renewed focus on supply chain resilience, with companies and governments alike seeking to reduce dependency on single regions and diversify their sources of supply.

C. Sustainability

Sustainability has become a crucial consideration for semiconductor companies, driven by both regulatory pressures and consumer demand for greener products. The industry is increasingly focused on energy efficiency, not just in the chips themselves but throughout the manufacturing process. Reducing carbon footprints, minimizing waste, and adopting circular economy principles are becoming integral to the strategies of leading semiconductor firms.

Business Model Analysis

Core Business Segments

Core Business Segments

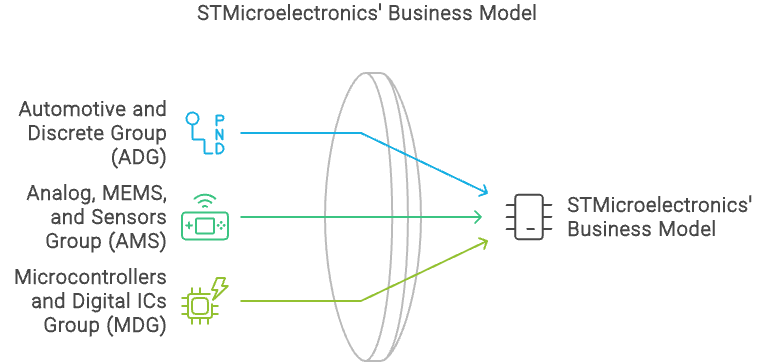

STMicroelectronics NV (STM) is a diversified global semiconductor company, structured around three primary business segments:

Automotive and Discrete Group (ADG):

STM is a major player in the automotive semiconductor market, which is rapidly expanding due to the growing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). STM's ADG segment focuses on power management and automotive applications, supplying key components for EV powertrains, battery management systems, and safety-critical ADAS technologies.Analog, MEMS, and Sensors Group (AMS):

The AMS segment of STM specializes in analog products, micro-electromechanical systems (MEMS), and sensors. These components are critical in a wide range of applications, including industrial automation, healthcare, and consumer electronics. STM’s sensors and MEMS products are essential for enabling IoT devices, providing the "eyes and ears" of modern technology through environmental monitoring, motion detection, and other sensing capabilities.Microcontrollers and Digital ICs Group (MDG):

This segment is at the core of STM's digital strategy, focusing on microcontrollers, digital ICs, and secure solutions. Microcontrollers are the workhorses of embedded systems, used in applications ranging from household appliances to complex industrial machines. STM's offerings in this segment are designed to meet the needs of high-performance, low-power, and secure applications, positioning the company as a leader in the rapidly growing market for embedded and IoT solutions.

Competitive Advantages

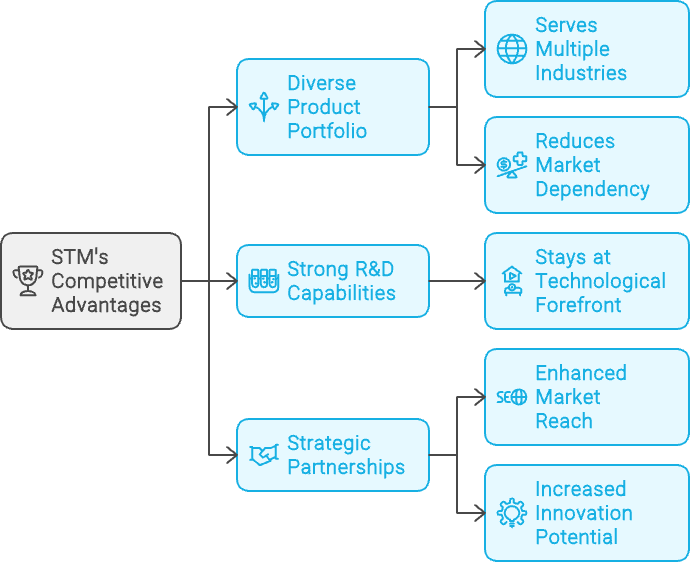

A. Diverse Product Portfolio

One of STM's most significant competitive advantages is its diverse product portfolio. By serving multiple industries, including automotive, industrial, and consumer electronics, STM reduces its dependency on any single market segment. This diversification not only provides a buffer against cyclical downturns in specific industries but also positions the company to capitalize on growth opportunities across different sectors.

B. Strong R&D Capabilities

Innovation is the lifeblood of the semiconductor industry, and STM's commitment to R&D is a key factor in its sustained success. The company invests heavily in developing new technologies, with a particular focus on next-generation semiconductors that address emerging trends such as AI, IoT, and 5G. STM's strong R&D capabilities enable it to maintain technological leadership and stay ahead of competitors in a rapidly evolving market.

C. Strategic Partnerships

STM has built a robust network of strategic partnerships with leading technology companies, automotive manufacturers, and academic institutions. These collaborations enhance STM's market reach, provide access to new technologies, and accelerate innovation. By working closely with partners, STM can rapidly develop and deploy new solutions that meet the evolving needs of its customers.

Financial Performance

A. Revenue and Profitability

STM has demonstrated consistent revenue growth over the past several years, driven by strong demand across its core business segments. The company’s financial performance is underpinned by a balanced portfolio that spans high-growth markets such as automotive and industrial applications. Key metrics to consider include revenue growth, profit margins, and return on equity (ROE), all of which have shown positive trends, reflecting STM's operational efficiency and market leadership.

B. Balance Sheet Strength

A strong balance sheet is crucial for any company operating in the capital-intensive semiconductor industry. STM has maintained a healthy balance sheet, characterized by low debt levels and adequate cash reserves. This financial stability provides the company with the flexibility to invest in future growth opportunities, weather economic downturns, and sustain its R&D initiatives.

C. Management Quality

The quality of STM's management team is another critical factor contributing to the company's success. The leadership's experience and strategic vision have been instrumental in navigating the challenges of the semiconductor industry. Moreover, STM places a strong emphasis on corporate governance, ensuring that it adheres to best practices in transparency, accountability, and ethical conduct. This focus on strong governance is not only important for maintaining investor confidence but also for sustaining long-term growth in a competitive industry.

🚀 Enroll now and discover how I transformed $2.3k into $27k in just one year! 🌟Learn More

Stay Ahead of Stocks Investment Ideas and Knowledge – Subscribe Today!

Stay ahead in the dynamic world of stock investments! Subscribe now to our newsletter and get the latest insights and trends in the financial markets delivered straight to your inbox. Be informed about the revolutionary advancements and investment opportunities that are reshaping our digital and economic landscapes. Click here to subscribe - Your future self will thank you!

Looking forward to our next update,

AiartGallerie

Reply