- AiartGallerie(Invest)'s Newsletter

- Posts

- 4 Undervalued Stocks You Should Not Ignore!

4 Undervalued Stocks You Should Not Ignore!

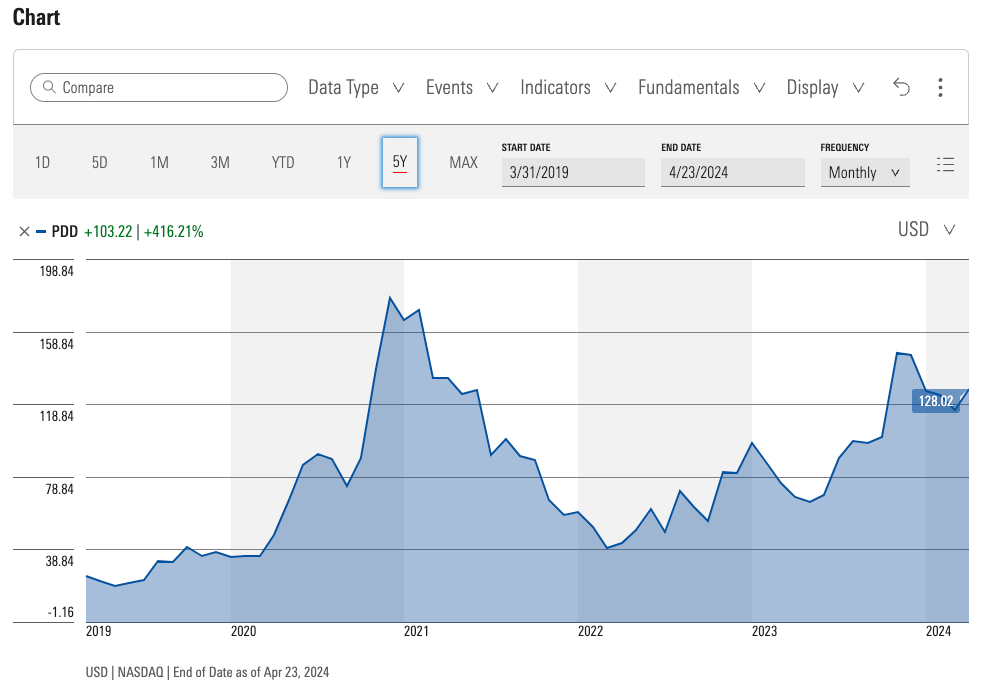

In the grand tapestry of the stock market, there lies a hidden dragon, coiled and ready to soar – its name is Pinduoduo. As we stand at the precipice of financial discovery, let's embark on an odyssey to unearth the treasures of the East. With Tencent's technological prowess, Baidu's intellectual might, and JD.com's commercial empire, we're not just talking stocks; we're talking about the keystones that could transform your portfolio from leaden to golden.

1) The Bargain Bin of Billionaires: Pinduoduo and Its Illustrious Companions

Screen Captured from Morningstar.com

In a world where stocks are often as overpriced as a tourist trap restaurant, Chinese stocks like Pinduoduo stand out like a beacon of value in a sea of inflated prices. Trading at less than 10 timten expected earnings, these stocks beckon with the siren call of untapped potential. But why, you ask, are these gems priced to move faster than hotcakes at a Sunday brunch?

Navigating the Labyrinth: The Risks and Rewards of Investing in China

Investing in Chinese stocks is akin to an adventurer decoding an ancient map. There are dragons to slay – geopolitical tensions, regulatory labyrinths, and the enigma of financial reporting. Yet, with a sprinkle of humor and a spirit of inspiration, we'll chart a course through these mystic waters, seeking fortunes that legends are made of.

From Silicon Valley to the Silk Road: The Case for Chinese Stocks in Your Portfolio

Imagine a portfolio not just robust in growth but rich in stories to regale your future self. This is the allure of adding a dash of China's market to your investment feast. And if investment sage Charlie Munger sees fit to allocate a significant portion – say, a cool 18% – to these Eastern marvels, who are we to shy away? As Munger himself muses, "So naturally, I'm willing to have some China risk in the Munger portfolio. How much China risk? Well, that's not a scientific subject, but I don't mind whatever it is, 18% or something."

The Oracle's Insight: Unveiling the Future of Pinduoduo and Its Cohorts

As we draw the curtains on this saga, remember that investing is a craft honed by the bold and the brave. Chinese stocks, with their tantalizing valuations and prospects for growth, could be the secret ingredient your portfolio craves. So, are you prepared to embrace the dragon's embrace?

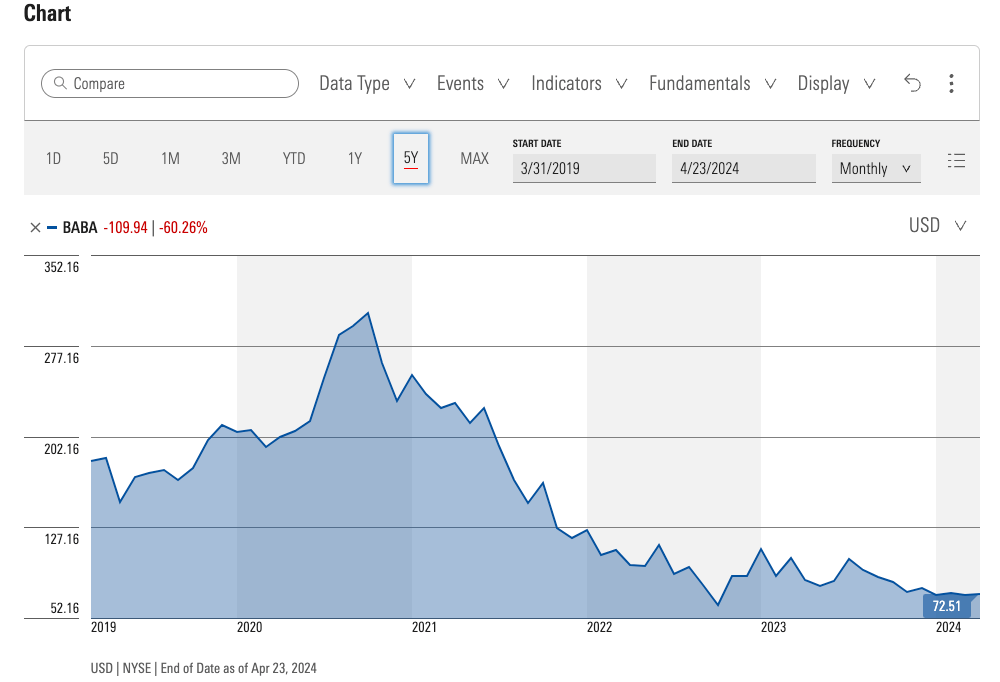

2) Alibaba: The E-commerce Emperor

Screen Captured from Morningstar.com

Alibaba, often likened to the Amazon of China, dominates the e-commerce landscape with its expansive online and mobile commerce platforms. Despite regulatory challenges and the competitive pressures that have impacted its stock price, Alibaba boasts a massive user base and a diversified business model that spans beyond e-commerce into cloud computing, digital media, and entertainment. Its robust infrastructure and continued growth in consumer spending in China make it a compelling choice for investors looking for exposure to China's consumer market.

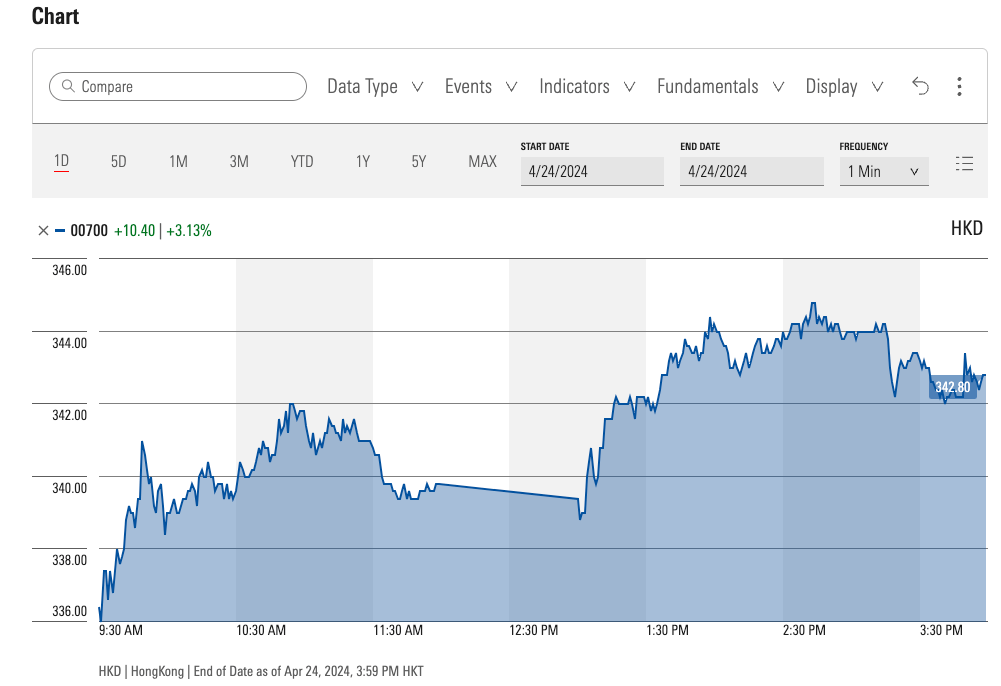

3) Tencent: The Titan of Tech and Entertainment

Screen Captured from Morningstar.com

Tencent, a behemoth in the realm of technology and entertainment, controls a significant portion of the gaming industry globally, thanks to hits like 'Honor of Kings'. It also operates WeChat, an app that's indispensable in China, combining messaging, social media, and mobile payment functions into a single platform. Tencent's diverse holdings in various tech sectors, including streaming, advertising, and cloud services, position it as a multifaceted player capable of weathering economic downturns and capitalizing on digital trends.

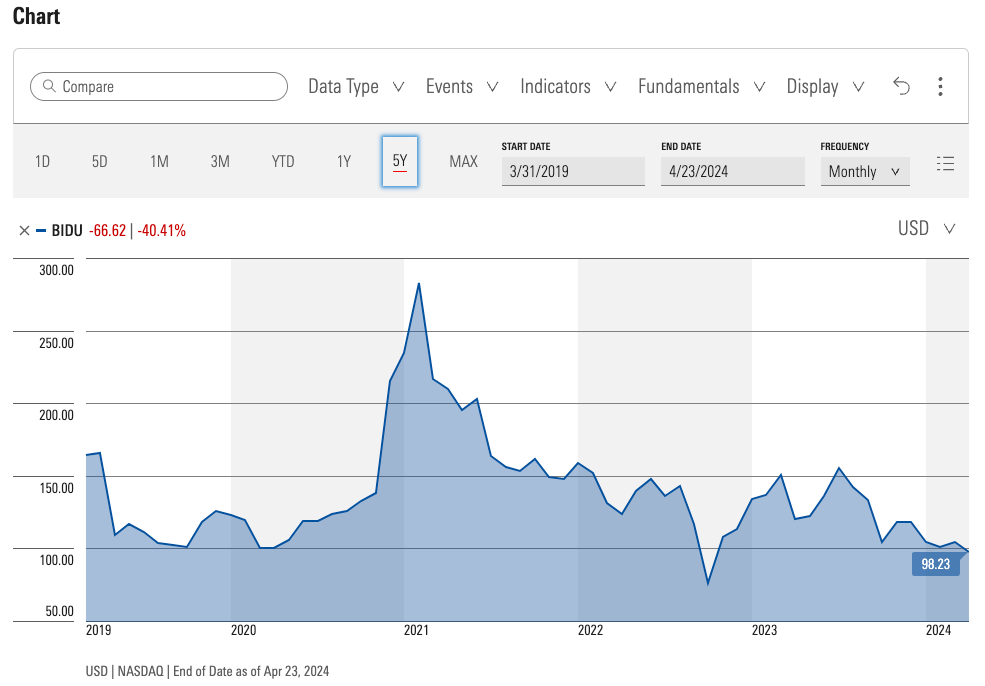

4) Baidu: The Beacon of AI and Internet Services

Screen Captured from Morningstar.com

Baidu, often referred to as the "Google of China," leads in Chinese internet search services and is making significant strides in artificial intelligence, particularly in autonomous driving and internet-related services. Its investment in AI has opened new revenue streams beyond its core search business, including cloud services and smart devices. Despite the competitive and regulatory landscape, Baidu's commitment to innovation and technology leadership makes it a potentially rewarding investment for those bullish on technology and AI.

Investment Considerations

While the allure of these companies is evident, they share common risks inherent to the Chinese market, including regulatory scrutiny and geopolitical tensions that can lead to volatility. However, their lower valuation metrics compared to some of their Western counterparts could represent a discount on their true potential, making them attractive for those willing to navigate the complexities of the Chinese market.

Incorporating companies like Alibaba, Tencent, and Baidu, alongside Pinduoduo, into a portfolio could offer a blend of growth, innovation, and exposure to China's vast consumer and technology sectors. With careful consideration of the risks and strategic diversification, these stocks could indeed be the gems that legends are made of.

Stay Ahead of AI Technologies and Stocks Investment – Subscribe Today!

Stay ahead in the dynamic world of AI technologies and stock investments by subscribing to our newsletter. We deliver the latest insights and trends in AI and the financial markets directly to your inbox. Keep informed about the revolutionary advancements and investment opportunities that are reshaping our digital and economic landscapes.

Looking forward to our next update,

AiartGallerie

Reply