- AiartGallerie(Invest)'s Newsletter

- Posts

- How M.I.L.O. Made this company a Global Giant 🌍📈

How M.I.L.O. Made this company a Global Giant 🌍📈

How M.I.L.O. - Mastering Innovation, Leveraging Opportunities Made this company a Global Giant? 🌍📈

Nestlé’s journey from a small, Swiss milk company to a global food giant is nothing short of legendary. It all started in 1867 when German-born pharmacist Henri Nestlé developed a milk-based baby food and quickly began marketing it. The product was an instant success, saving the lives of infants who couldn’t be breastfed. Nestlé’s innovative spirit didn’t stop there. Over the decades, the company expanded into new territories and diversified its product range, always staying ahead of consumer trends and technological advancements.

In the 1920s, Nestlé began acquiring chocolate companies, a move that led to the creation of iconic brands like KitKat and Milkybar. The post-World War II era saw Nestlé embracing globalization. It expanded into developing markets, introduced instant coffee with Nescafé, and continued its tradition of innovation. The 1970s brought diversification into the pharmaceutical sector and the acquisition of brands like Alcon Laboratories, further strengthening Nestlé’s market position.

Fast forward to the 21st century, Nestlé is a paragon of sustainability and innovation. With over 2,000 brands, the company continues to evolve, focusing on nutrition, health, and wellness. It’s a story of relentless pursuit of excellence, adaptability, and a commitment to improving lives globally.

Company Background, Development, and Industry Knowledge

Nestlé, headquartered in Vevey, Switzerland, is the largest food company in the world, measured by revenues and other metrics, such as profits. The company’s operations span across 188 countries with a vast product portfolio that includes baby food, bottled water, breakfast cereals, coffee and tea, confectionery, dairy products, ice cream, frozen food, pet foods, and snacks.

Nestlé’s history is a tale of continuous growth and adaptation. The company has embraced technological advancements and changes in consumer behavior to remain at the forefront of the food industry. Nestlé’s significant investments in research and development underscore its commitment to innovation. The company operates 23 research, development, and technology facilities around the world, employing around 5,000 people in R&D alone .

One of Nestlé’s critical strategic focuses is nutrition, health, and wellness. This focus is evident in its product innovations, such as the development of plant-based food alternatives and the incorporation of advanced nutritional science into its products. Nestlé’s Health Science division is particularly noteworthy, providing products aimed at specific dietary needs, such as BOOST Glucose Control and NAN Supreme Pro .

Nestlé’s industry knowledge is unparalleled. It has a profound understanding of local markets and consumer preferences, allowing it to tailor products to meet specific regional needs. This capability is augmented by its strategic acquisitions, which have helped Nestlé maintain its competitive edge and enter new markets effectively.

Screen Captured from Morningstar.com

Moat: Nestlé’s Competitive Advantages

Nestlé’s moat is built on several pillars:

1. Brand Strength and Diversification: Nestlé’s portfolio includes some of the world’s most recognized brands, such as Nescafé, KitKat, and Purina. This brand recognition and loyalty provide a significant competitive advantage.

2. Research and Development: With an industry-leading R&D budget, Nestlé continuously innovates, bringing new and improved products to market. This focus on innovation helps maintain its leadership position.

3. Global Presence and Scale: Nestlé operates in virtually every country in the world. This extensive reach allows it to leverage economies of scale and mitigate regional economic fluctuations .

Financial Strength

Profit and Loss Statement:

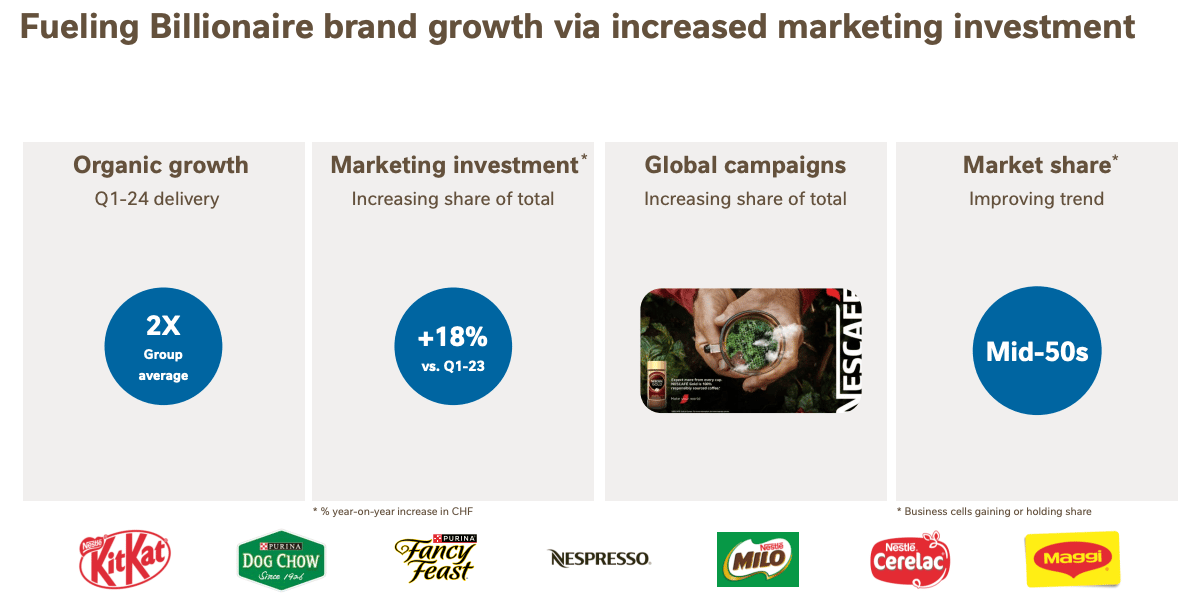

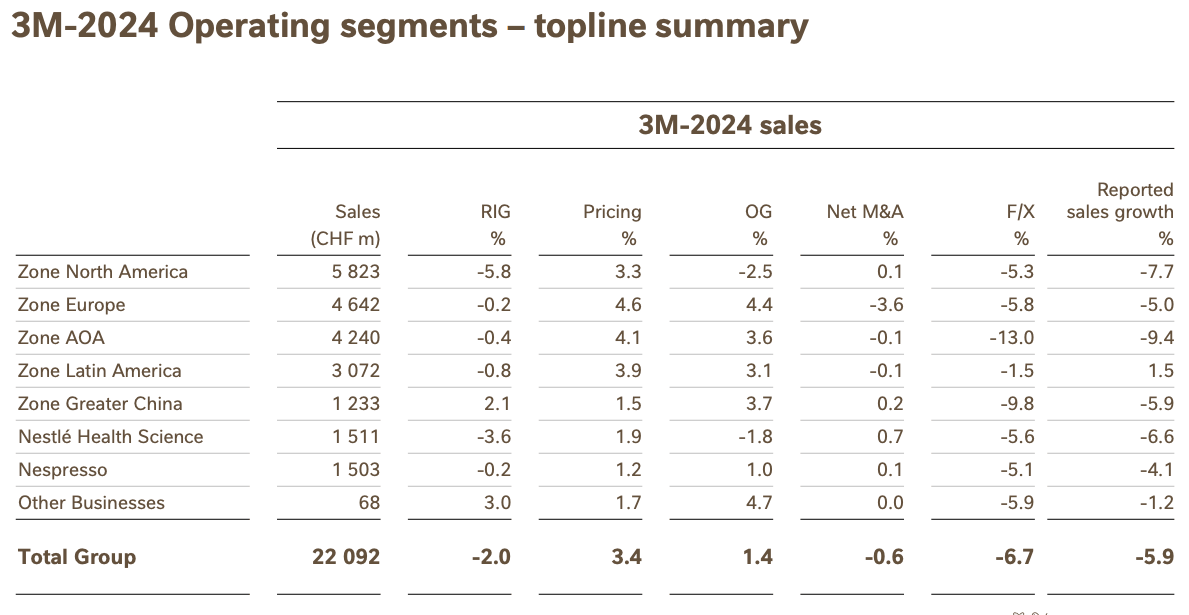

Nestlé’s financial performance remains robust. For the full year 2023, the company reported organic growth of 7.2%, with group sales reaching CHF 93 billion. Despite a slight dip in real internal growth (-0.3%), the underlying trading operating profit margin improved by 40 basis points to 17.3% . This indicates efficient cost management and operational effectiveness.

Balance Sheet:

Nestlé maintains a strong balance sheet. In 2023, the company proposed a dividend increase to CHF 3.00 per share, reflecting its commitment to returning value to shareholders while ensuring sufficient capital for growth initiatives .

Cash Flow Statement:

Nestlé’s operating cash flow in 2023 was CHF 15.9 billion, supporting a free cash flow of CHF 10.4 billion. This robust cash flow generation is critical for funding investments in innovation, acquisitions, and shareholder returns .

Risks to Consider

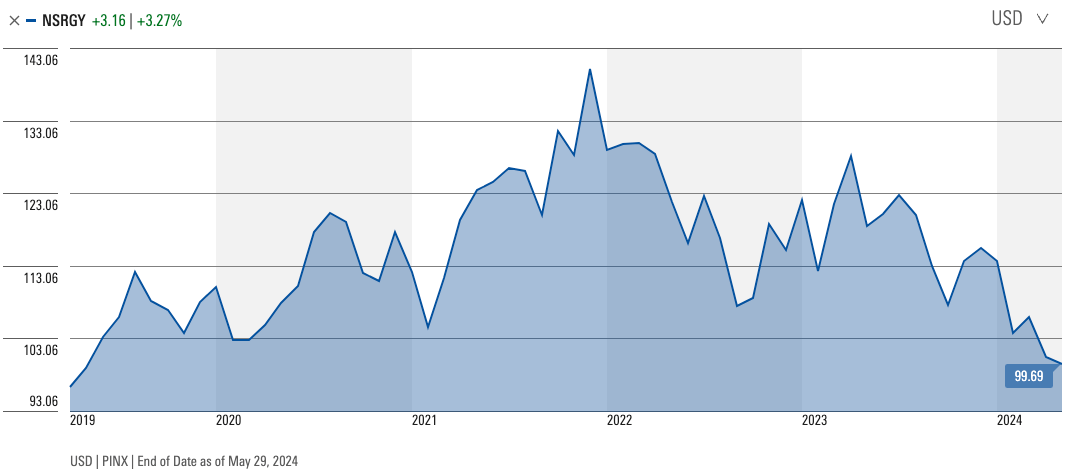

1. Market and Economic Conditions: Nestlé’s operations are susceptible to economic downturns and fluctuations in foreign exchange rates. For instance, in the first three months of 2024, the company experienced a 5.9% decrease in reported sales due to foreign exchange impacts .

2. Regulatory Risks: Navigating diverse and evolving regulations across its global operations can be challenging and costly. Compliance with food safety, environmental, and corporate governance standards requires significant resources.

3. Supply Chain Disruptions: Nestlé faces potential risks from supply chain constraints. For example, temporary supply constraints in the vitamins, minerals, and supplements business have impacted growth, necessitating effective management strategies

Nestlé’s long-term investment potential is grounded in its strong financial performance, significant competitive advantages, efficient management, and proactive risk management. The company’s focus on innovation, sustainability, and global expansion positions it well for sustained growth.

As an investor, understanding Nestlé’s ability to adapt and thrive in changing market conditions can provide confidence in its potential for long-term returns. The company’s dedication to innovation and sustainability not only meets current consumer demands but also sets the stage for future growth.

Stay Ahead of Stocks Investment Ideas and Knowledge – Subscribe Today!

Stay ahead in the dynamic world of stock investments! Subscribe now to our newsletter and get the latest insights and trends in the financial markets delivered straight to your inbox. Be informed about the revolutionary advancements and investment opportunities that are reshaping our digital and economic landscapes. Click here to subscribe - Your future self will thank you!

Looking forward to our next update,

AiartGallerie

Reply