- AiartGallerie(Invest)'s Newsletter

- Posts

- JOMO, Warren Buffett's Timeless Wisdom from the 2024 Berkshire Hathaway AGM

JOMO, Warren Buffett's Timeless Wisdom from the 2024 Berkshire Hathaway AGM

In an era where rapid technological advancements and market volatility can sway even the most seasoned investors, Warren Buffett's voice remains a beacon of clarity and enduring wisdom. During the 2024 Annual General Meeting (AGM) of Berkshire Hathaway, Buffett distilled decades of investment prowess into key insights that not only promise to enrich your portfolio but also aim to enhance the quality of your life. Here's how Buffett's latest pearls of wisdom can help you navigate the complexities of investing and life.

Understand Before You Invest

Buffett’s investment strategy is rooted in the principle of thoroughly understanding a potential investment. This means not just understanding the company’s business model, but also its competitive landscape, its financial health, and its potential for growth. He believes in investing in businesses that he understands, which means he can predict with some degree of certainty how the company will perform in the future.

Buffett and Munger’s ability to make quick decisions does not come from impulsive thinking, but rather from years of contemplation and experience. They have spent decades honing their investment philosophy and understanding the types of businesses they want to invest in. When an opportunity arises that fits within their parameters, they are able to act quickly.

Buffett’s investment in Apple is a prime example of his investment philosophy. Despite being a technology company, a sector Buffett traditionally avoided, he invested in Apple because he understood the consumer behavior around its products. He recognized the brand loyalty of Apple customers and the recurring revenue generated from its ecosystem of products and services. Only after he had a full grasp of these factors did he make a sizable investment in Apple.

In conclusion, Buffett’s approach to smart investing involves a deep understanding of the investment, patience in decision-making, and the ability to act quickly when the right opportunity presents itself. It’s a strategy that has proven successful over the long term and one that continues to guide his investment decisions.

The Danger of Impulse Buying

Warren Buffett is known for his disciplined approach to investing. He doesn’t let emotions or market hype dictate his investment decisions. Instead, he relies on thorough research and analysis. This means he doesn’t buy any investment based on vibes or impulse. He takes his time to understand the business, its competitive position, its financials, and its future prospects before making an investment decision.

A prime example of this approach is his investment in Apple. Despite the hype around Apple products, Buffett didn’t immediately jump on the bandwagon. Instead, he took his time to understand the product, the company, and most importantly, the consumer behavior around the iPhone.

He observed that the iPhone had become an integral part of people’s lives and that Apple had a loyal customer base. He also noticed that the iPhone was not just a product, but a part of a larger ecosystem of products and services that Apple had built. This ecosystem created a recurring revenue stream for Apple, which is a positive sign for any investor.

Only after he determined that the iPhone was “maybe the greatest product of all time,” did he decide to invest in Apple. This decision was not made on impulse or because of market hype, but was the result of careful consideration and analysis.

In conclusion, Buffett’s approach to avoiding impulse buying is a testament to his disciplined and thoughtful approach to investing. It’s a strategy that has served him well over the years and continues to be a guiding principle in his investment decisions.

JOMO, No Fear of Missing Out (FOMO)

Warren Buffett’s investment philosophy is grounded in rationality and patience, not in “Fear of Missing Out,” or FOMO. He believes in the power of informed decision-making and does not let the fear of missing out drive his investment decisions. This means he doesn’t rush into an investment just because it’s the latest trend or because others are investing in it.

In fact, Buffett embodies the concept of the “Joy of Missing Out,” or JOMO. Unlike FOMO, which is driven by a fear of regret or a sense of social pressure, JOMO is about finding joy and contentment in one’s own path, even if it means missing out on what others are doing. For Buffett, this means taking pleasure in the thorough research process, enjoying the intellectual challenge of understanding a company, and finding satisfaction in making informed, rational investment decisions.

Buffett is known for his exhaustive research into the companies he invests in. He believes in understanding the ins and outs of a company, its business model, its competitive landscape, its financial health, and its future prospects before making an investment decision. If he hasn’t devoted the necessary time and effort to understand a company or product, he won’t invest in it, even if it means missing out on a potentially lucrative opportunity. This is where JOMO comes into play - Buffett finds joy in the process of understanding and analyzing, rather than rushing into decisions.

Buffett’s long-term investment perspective also plays a role in his lack of FOMO and his embodiment of JOMO. He understands that investment opportunities will come and go, but what matters most is the long-term performance of his investments. He is willing to wait for the right opportunity rather than rush into an investment out of fear of missing out. He finds joy in this patience and in the anticipation of the right opportunity.

In conclusion, Buffett’s approach to investing is characterized by patience, thorough research, a long-term perspective, and a sense of JOMO. He does not let FOMO dictate his investment decisions. Instead, he focuses on making informed decisions based on his understanding of a company or product, and finds joy in the process. This approach, which embraces JOMO over FOMO, has served him well over the years and is a key factor in his success as an investor.

Get value stock insights free.

PayPal, Disney, and Nike recently dropped 50-80%. Are they undervalued? Can they recover? Read Value Investor Daily to find out. We read hundreds of value stock ideas daily and send you the best.

Writing Your Life's Script

The concept of “writing your own obituary” is a metaphor that Buffett uses to emphasize the importance of living a life of integrity and purpose. He suggests that one should live their life in such a way that they would be proud of their own obituary. This means making decisions and taking actions that align with one’s values and principles, and that contribute positively to the world.

This philosophy also reflects Buffett’s long-term perspective. Just as he advocates for long-term investment strategies, he also believes in taking a long-term view of life. He encourages people to think about how they want to be remembered, and to make choices that will lead to a legacy they can be proud of.

Buffett’s emphasis on “writing your own obituary” also highlights the importance he places on the impact we have on others. He believes that our actions and decisions should not only benefit us personally, but also have a positive impact on those around us. This is evident in his philanthropic efforts, where he has pledged to give away the majority of his wealth to charitable causes.

Finally, the idea of “writing your own obituary” underscores the importance of personal accountability. Buffett suggests that we should be the authors of our own lives, taking responsibility for our actions and their outcomes. This means not blaming others for our failures, but learning from them and using them as opportunities for growth.

In conclusion, Buffett’s advice to “write your own obituary” is a powerful reminder to live a life of integrity, to consider the long-term consequences of our actions, to strive for a positive impact on others, and to take personal responsibility for our lives. It’s a philosophy that has guided his own life and career, and one that he continues to share with others.

In a market driven by trends and hype, Buffett's call to avoid "herd mentality" and to strip away emotion from investment decisions is particularly pertinent. He champions an approach that values individual judgment and critical thinking, which can lead to more secure and profitable investments.

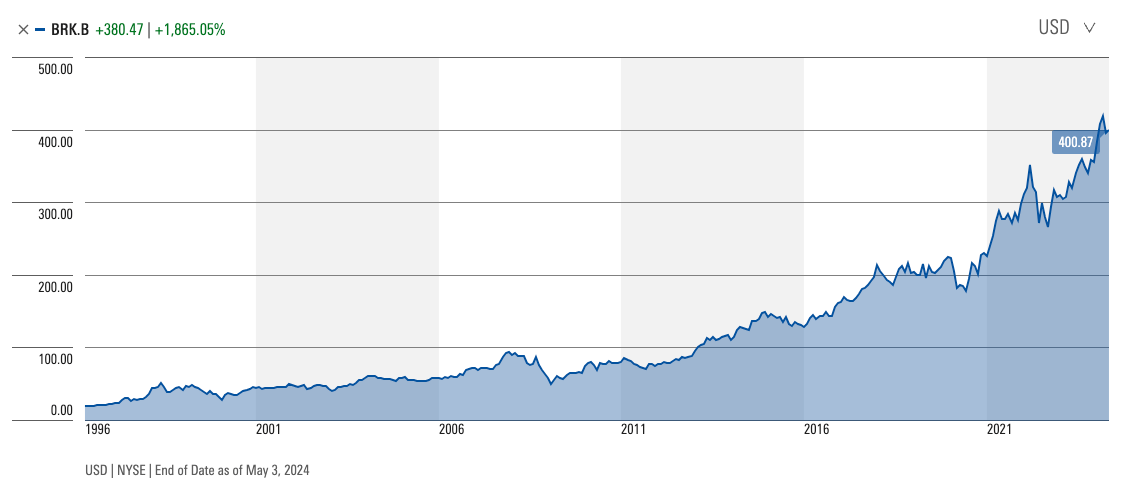

Screen Captured from Morningstar.com

Invesment Strategy

The core of this strategy is the idea of buying “wonderful businesses at fair prices”. This means investing in companies that have a strong competitive advantage, excellent management, and a track record of profitability, and buying them at a price that is reasonable given their intrinsic value.

The second part of the strategy is equally important: giving up the opportunity to buy “fair businesses at wonderful prices”. This means avoiding the temptation to invest in mediocre companies just because their stock is cheap. Buffett and Munger believe that it’s better to buy a great company at a fair price than a fair company at a great price.

This strategy also involves a long-term focus. Buffett and Munger are not interested in making a quick profit from short-term market fluctuations. Instead, they invest in companies that they believe will be successful over the long term.

Charlie Munger, as the “architect of Berkshire”, played a crucial role in developing this investment strategy. His influence on Buffett and Berkshire Hathaway’s investment philosophy cannot be overstated. His focus on quality over price, long-term value over short-term gain, and his rigorous approach to evaluating investment opportunities have been key to Berkshire Hathaway’s success.

In conclusion, the investment strategy of buying “wonderful businesses at fair prices” and giving up “fair businesses at wonderful prices” has been a cornerstone of Berkshire Hathaway’s success. It’s a strategy that requires discipline, patience, and a keen understanding of business fundamentals. It’s also a testament to the influence and wisdom of Charlie Munger, who Buffett credits as the architect of Berkshire Hathaway’s investment philosophy.

Stay Ahead of Stocks Investment Ideas and Knowledge – Subscribe Today!

Stay ahead in the dynamic world of stock investments and AI technologiesby subscribing to our newsletter. We deliver the latest insights and trends in AI and the financial markets directly to your inbox. Keep informed about the revolutionary advancements and investment opportunities that are reshaping our digital and economic landscapes.

Looking forward to our next update,

AiartGallerie

Reply