- AiartGallerie(Invest)'s Newsletter

- Posts

- Key Factors in Nikes Strategy for Outperforming Competitors

Key Factors in Nikes Strategy for Outperforming Competitors

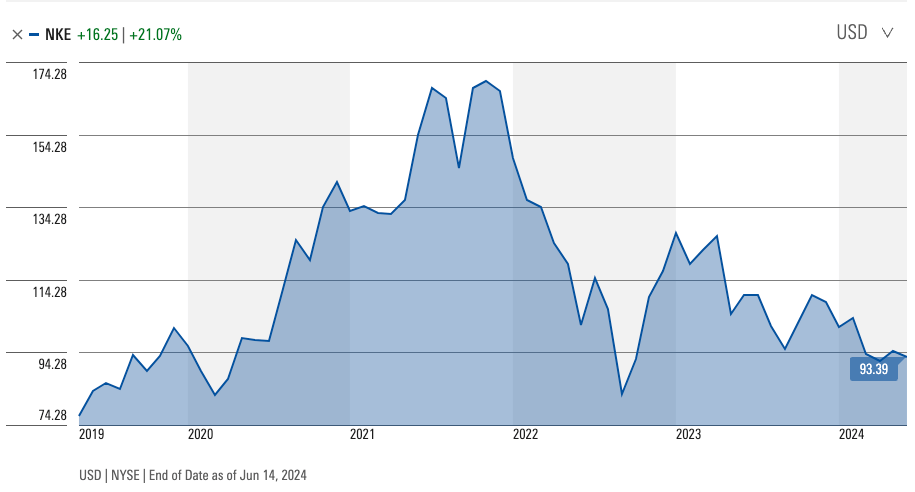

Welcome to AiArtGallerie, your trusted source for uncovering undervalued stocks with remarkable potential. This week, we delve into the fascinating journey of Nike, Inc. (NYSE: NKE), a titan in the athletic apparel industry. As we explore Nike’s financial strength, competitive advantages, management efficiency, and potential risks, we’ll employ Warren Buffett’s timeless investment principles to assess its long-term investment value.

The Legendary Rise of Nike

Nike’s story is nothing short of legendary. It all began in 1964 when Phil Knight, a track athlete at the University of Oregon, and his coach, Bill Bowerman, embarked on a mission to revolutionize athletic footwear. Initially operating as Blue Ribbon Sports, the company distributed Japanese running shoes. The partnership between Knight and Bowerman was built on innovation and a relentless pursuit of excellence. Bowerman’s desire to create lighter, more comfortable shoes for his athletes led to groundbreaking innovations that would redefine the industry.

By 1971, the company rebranded as Nike, inspired by the Greek goddess of victory. The iconic Swoosh logo, designed by a college student for a mere $35, became synonymous with athletic excellence. Nike’s breakthrough moment came in 1972 when Bowerman introduced the revolutionary Waffle Trainer, featuring a unique outsole pattern inspired by his wife’s waffle iron. This innovation provided superior traction and comfort, propelling Nike to the forefront of the athletic footwear market.

Over the decades, Nike’s commitment to innovation and marketing prowess catapulted it to global dominance. The signing of basketball prodigy Michael Jordan in 1984 marked a watershed moment, birthing the Air Jordan line that would become a cultural phenomenon. Nike’s bold and imaginative marketing campaigns, epitomized by the “Just Do It” slogan introduced in 1988, resonated deeply with consumers, cementing its status as a cultural icon.

Unlock the secrets to tripling your profits with our comprehensive options trading course! 📈💰 Learn from the legendary strategies of Warren Buffett and master powerful techniques like bull put spreads, iron condors, and straddles. From understanding the basics of options to implementing advanced strategies, our course equips you with everything you need to turn small investments into significant gains. 🚀 Enroll now and discover how I transformed $2.3k into $27k in just one year! 🌟Learn More

Financial Strength

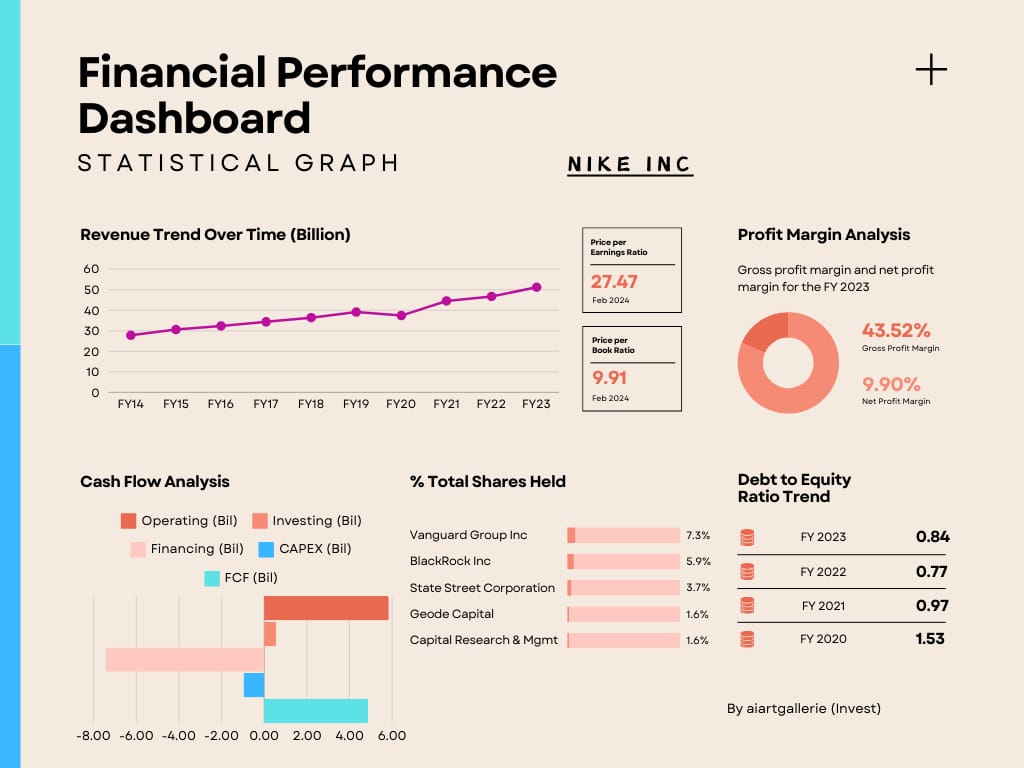

Profit and Loss Statement Analysis

Nike’s financial health is a testament to its robust business model. For the third quarter of fiscal 2024, Nike reported revenues of $12.4 billion, reflecting a slight increase from the previous year . The gross margin improved to 44.8%, demonstrating efficient cost management and strategic pricing. However, net income decreased by 5% to $1.2 billion, primarily due to restructuring charges . This indicates that while Nike continues to grow its top line, it is also investing in its long-term strategic initiatives.

Balance Sheet Analysis

Nike’s balance sheet showcases its financial resilience. As of February 2024, the company reported total assets of $37.4 billion and liabilities of $23.1 billion . With cash and equivalents totaling $10.6 billion, Nike maintains strong liquidity to navigate market fluctuations and invest in growth opportunities. The company’s inventory management has also improved, with a 13% decrease in inventories, highlighting better efficiency in handling supply chain challenges.

Cash Flow Statement Analysis

Nike’s ability to generate strong cash flow from operations is a critical indicator of its financial health. In the third quarter of fiscal 2024, Nike returned $1.4 billion to shareholders through dividends and share repurchases . This consistent cash flow allows Nike to invest in innovation, expand its market presence, and reward shareholders, reinforcing its long-term growth prospects.

Competitive Advantages

Nike’s enduring success is anchored in several competitive advantages:

1. Strong Brand Equity: Nike’s brand is one of the most recognized and respected in the world. The Swoosh logo and “Just Do It” slogan symbolize athletic excellence and innovation, creating a powerful brand loyalty that is difficult for competitors to replicate.

2. Innovation and Product Development: Continuous investment in research and development has enabled Nike to introduce groundbreaking products like Flyknit and Air Max technologies . These innovations not only enhance athletic performance but also set Nike apart in a crowded marketplace.

3. Global Reach and Diverse Portfolio: Nike’s extensive global footprint and diversified product lines allow it to cater to various market segments, reducing dependence on any single product or region . This diversification provides a buffer against market volatility and regional economic downturns.

Management Efficiency

Nike’s management team has demonstrated remarkable efficiency and strategic vision:

1. Operational Adjustments: Nike’s focus on operational efficiency, including restructuring efforts to streamline operations, has positively impacted gross margins despite the associated costs . This indicates a proactive approach to maintaining profitability in a dynamic market environment.

2. Strategic Vision: Under the leadership of CEO John Donahoe and CFO Matthew Friend, Nike continues to emphasize innovation and market expansion . Their strategic initiatives, such as enhancing digital capabilities and expanding direct-to-consumer sales, position Nike for sustainable long-term growth.

3. Employee and Culture Focus: Nike invests significantly in its workforce and corporate culture, fostering a creative and inclusive environment that supports innovation . This commitment to employee well-being and development ensures a motivated and productive team.

Screen captured from Morningstar.com

Major Risks

Investing in Nike involves certain risks that investors should consider:

1. Economic and Market Conditions: Global economic downturns can impact consumer spending on discretionary items like athletic apparel and footwear. A prolonged economic slump could adversely affect Nike’s sales and profitability .

2. Competition: The athletic footwear and apparel market is highly competitive, with rivals like Adidas and Under Armour continuously challenging Nike’s market position . Maintaining its competitive edge requires ongoing investment in innovation and marketing.

3. Supply Chain Disruptions: Nike’s reliance on international manufacturing exposes it to risks such as political instability, trade restrictions, and supply chain disruptions . Ensuring a resilient supply chain is crucial to mitigating these risks.

Unlock the secrets to tripling your profits with our comprehensive options trading course! 📈💰 Learn from the legendary strategies of Warren Buffett and master powerful techniques like bull put spreads, iron condors, and straddles. From understanding the basics of options to implementing advanced strategies, our course equips you with everything you need to turn small investments into significant gains. 🚀 Enroll now and discover how I transformed $2.3k into $27k in just one year! 🌟Learn More

Additional Insights

In addition to the core financial and strategic analysis, it’s important to consider the broader context in which Nike operates. Nike leverages modern technologies like virtual machines and cloud storage to optimize its operations. The company’s data-driven decision-making process is a testament to its commitment to continuous improvement and innovation.

Nike’s marketing strategy incorporates elements of digital marketing and social media marketing. By analyzing google trends and leveraging social media platforms, Nike effectively engages with its target audience. This approach is part of a broader trend in the industry towards utilizing digital marketing to revolutionize real estate and other sectors.

Nike also values the mental well-being of its employees. By addressing mental health concerns and promoting a patient-centered mental health approach, Nike fosters a supportive work environment. Initiatives like the PPP Training program and the Streamflow Information Program exemplify Nike’s commitment to employee development and environmental sustainability.

Conclusion

Nike exemplifies many of Warren Buffett’s investment principles, including strong brand equity, a focus on innovation, and robust financial health. While there are inherent risks, Nike’s strategic management and consistent performance make it a compelling long-term investment. As Buffett would advise, focusing on the company’s enduring competitive advantages and prudent management can offer investors confidence in Nike’s future growth.

Summary

In this newsletter, we’ve explored Nike’s fascinating journey from a small start-up to a global powerhouse. We examined Nike’s financial strength, highlighting its consistent revenue growth and strong balance sheet. We also delved into Nike’s competitive advantages, including its strong brand equity and relentless innovation. Furthermore, we assessed Nike’s management efficiency and identified potential risks that investors should consider.

Final Thought

Nike’s ability to innovate and adapt has been the cornerstone of its success. As we look to the future, consider this: In a world where trends come and go, investing in a company with a proven track record of resilience and innovation might just be the winning strategy.

Stay Ahead of Stocks Investment Ideas and Knowledge – Subscribe Today!

For further insights into Nike’s financial performance, you can access the full reports here and here. Stay tuned for our next edition of AiArtGallerie, where we’ll uncover another hidden gem in the world of stock investment. Remember, the key to successful investing is not just finding the right stocks, but understanding the stories behind them.

Reply