- AiartGallerie(Invest)'s Newsletter

- Posts

- 🍅 Kraft Heinz Losing Its Flavor? 3 Shocking Numbers You Need to Know Before Investing! 📉

🍅 Kraft Heinz Losing Its Flavor? 3 Shocking Numbers You Need to Know Before Investing! 📉

Shifting Market

Kraft Heinz is a name that resonates with nearly every household. From Heinz ketchup to Kraft mac and cheese, its products have been trusted staples for decades. However, in today’s ever-evolving food landscape, where consumers are demanding healthier options and supply chains are under pressure, can Kraft Heinz maintain its iconic status?

Born from the 2015 merger of Kraft Foods and H.J. Heinz, the company emerged as a global food powerhouse. But keeping its leading position requires adapting to new challenges. Rising inflation, shifts in consumer behavior, and volatile commodity prices are just a few of the factors shaping Kraft Heinz’s future. Their 2023 financials give us a snapshot of how the company is navigating these complexities.

But is it enough to convince investors that Kraft Heinz remains a solid long-term bet?

1. Financial Overview: Growth Amid Challenges

Net Sales & Operating Income:

Kraft Heinz reported net sales of $26.6 billion in 2023, reflecting a modest increase from $26.4 billion in 2022. This growth is primarily driven by strategic pricing increases, allowing the company to offset rising input costs. However, the pressure of higher costs of products sold, which reached $17.7 billion, continues to weigh on profitability.

Despite these headwinds, the company achieved a significant 25.8% rise in operating income, from $3.6 billion to $4.6 billion. This uptick came through cost-cutting initiatives and operational efficiencies, demonstrating Kraft Heinz’s commitment to maintaining profitability in a tough environment.

Impairment Concerns:

However, not all was rosy. The company recorded $510 million in impairment losses on goodwill and $152 million on intangible assets in 2023. These figures raise red flags for investors, signaling potential challenges in extracting value from past acquisitions.

2. Understanding the Competitive Moat

One of Kraft Heinz's key strengths lies in its brand portfolio. With household names like Heinz, Kraft, Planters, and Oscar Mayer, the company commands significant market share across various categories. Its ability to leverage this brand equity and a vast global distribution network gives it a competitive advantage over smaller players in the market.

But is this moat impenetrable?

The recurring impairment losses hint at underperforming brands or missteps in certain geographies. As consumers shift towards fresh, organic, and plant-based options, Kraft Heinz must evolve to meet these demands or risk losing its edge.

3. Balance Sheet and Financial Health

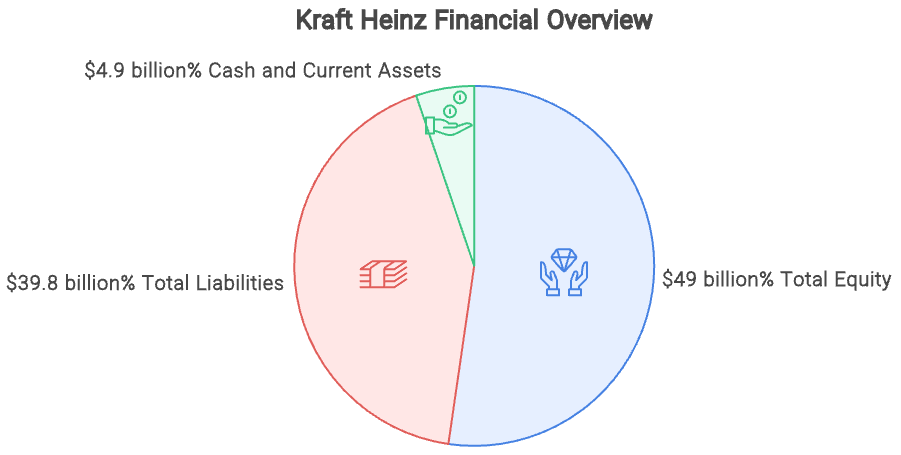

Kraft Heinz’s balance sheet remains solid, with $49 billion in total equity. However, total liabilities reached $39.8 billion, driven by non-current liabilities such as long-term debt. The company’s high debt load is something to monitor closely, especially in a rising interest rate environment. Cash and current assets are stable at $4.9 billion, providing sufficient liquidity.

While the company is actively paying down debt, rising interest rates could increase the burden on its finances, potentially squeezing future profitability.

4. Cash Flow Analysis: A Look at Liquidity

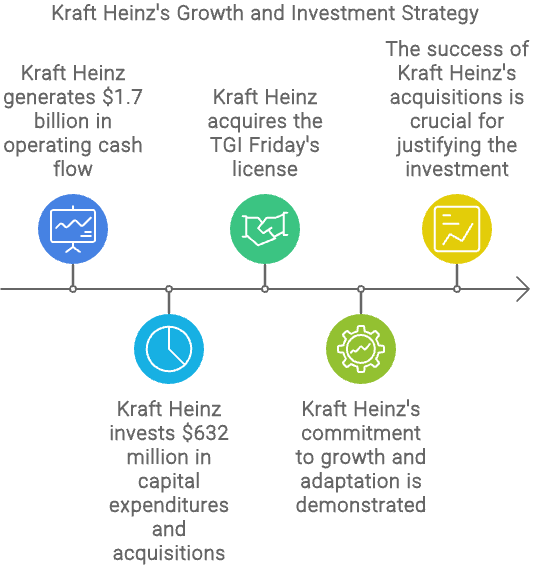

In the first half of 2024, Kraft Heinz generated $1.7 billion in operating cash flow, a testament to its ability to manage day-to-day operations effectively. The company continues to invest in growth, spending $632 million on capital expenditures and acquisitions, such as its investment in the TGI Friday’s license.

For investors, this shows that Kraft Heinz is committed to growing and adapting, but its acquisitions must deliver strong returns to justify the outlay.

5. Key Risks: What Investors Should Watch

Commodity Price Fluctuations:

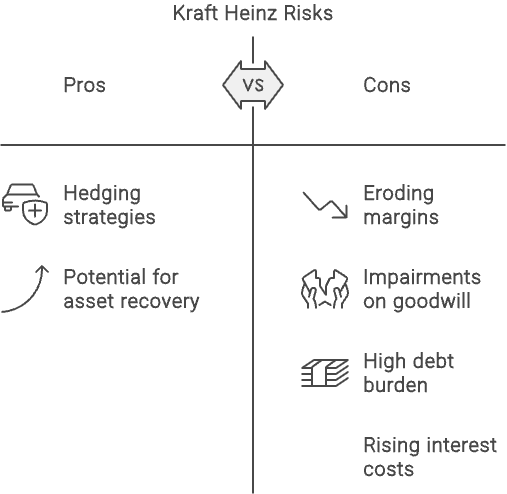

Kraft Heinz is highly dependent on commodities like dairy, grains, and meats. Sharp increases in these input costs can erode margins. Although the company employs hedging strategies, these measures only offer partial protection.

Goodwill and Intangible Asset Impairments:

Impairments on intangible assets, including $510 million on goodwill, reflect potential struggles with acquisitions. If the company fails to extract value from these assets, it could impact long-term growth prospects.

Debt Levels:

With liabilities reaching $39.8 billion, the company’s debt burden is significant. Rising interest rates could increase costs associated with servicing this debt, potentially hindering free cash flow.

6. Future Growth Catalysts: Innovations to Watch

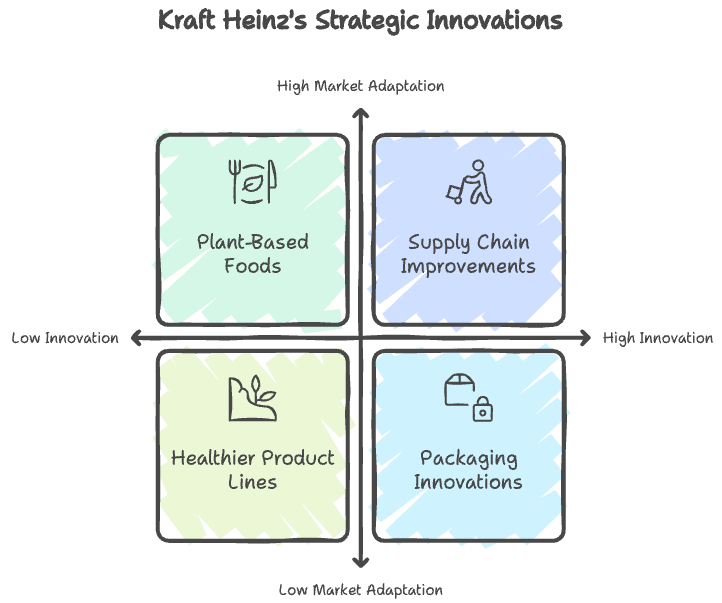

To adapt to shifting consumer preferences, Kraft Heinz is expanding its offerings in plant-based foods and healthier product lines. These innovations cater to health-conscious consumers, who are increasingly seeking sustainable, organic, and low-processed options. Additionally, Kraft Heinz is investing in supply chain improvements and packaging innovations that could boost efficiency and drive growth.

The company’s focus on modernizing its operations and products is essential to its long-term success in a changing food market.

7. Conclusion

Summary:

Kraft Heinz remains a powerhouse in the food industry with its iconic brands and a strong market presence. The company's operating income growth and strategic cost-cutting measures have helped offset inflationary pressures. However, concerns around goodwill impairments, commodity price volatility, and its debt load present risks for potential investors.

Final Thought:

For investors looking at Kraft Heinz as a long-term hold, the key question remains: Can the company effectively modernize while preserving its brand legacy? If it can successfully adapt to changing consumer preferences and manage its debt, Kraft Heinz could remain a staple in not just kitchens, but in your portfolio.

Stay Ahead of Stocks Investment Ideas and Knowledge – Subscribe Today!

Stay ahead in the dynamic world of stock investments! Subscribe now to our newsletter and get the latest insights and trends in the financial markets delivered straight to your inbox. Be informed about the revolutionary advancements and investment opportunities that are reshaping our digital and economic landscapes. Click here to subscribe - Your future self will thank you!

Looking forward to our next update,

AiartGallerie

Reply