- AiartGallerie(Invest)'s Newsletter

- Posts

- Pfizer Inc.: The Underappreciated Superstar

Pfizer Inc.: The Underappreciated Superstar

Introduction

As a beacon in the pharmaceutical landscape, Pfizer Inc. garnered immense attention during the COVID-19 pandemic. However, with the world pivoting towards recovery, the narrative surrounding Pfizer has evolved significantly. This newsletter delves into the latest twists in Pfizer’s saga, examining its Q1 2024 earnings, recent stock declines, shareholder reactions, strategic cost-cutting, and robust pipeline. We will uncover why, despite current hurdles, Pfizer remains a promising entity for long-term investment.

Q1 2024 Earnings: Beyond the Numbers

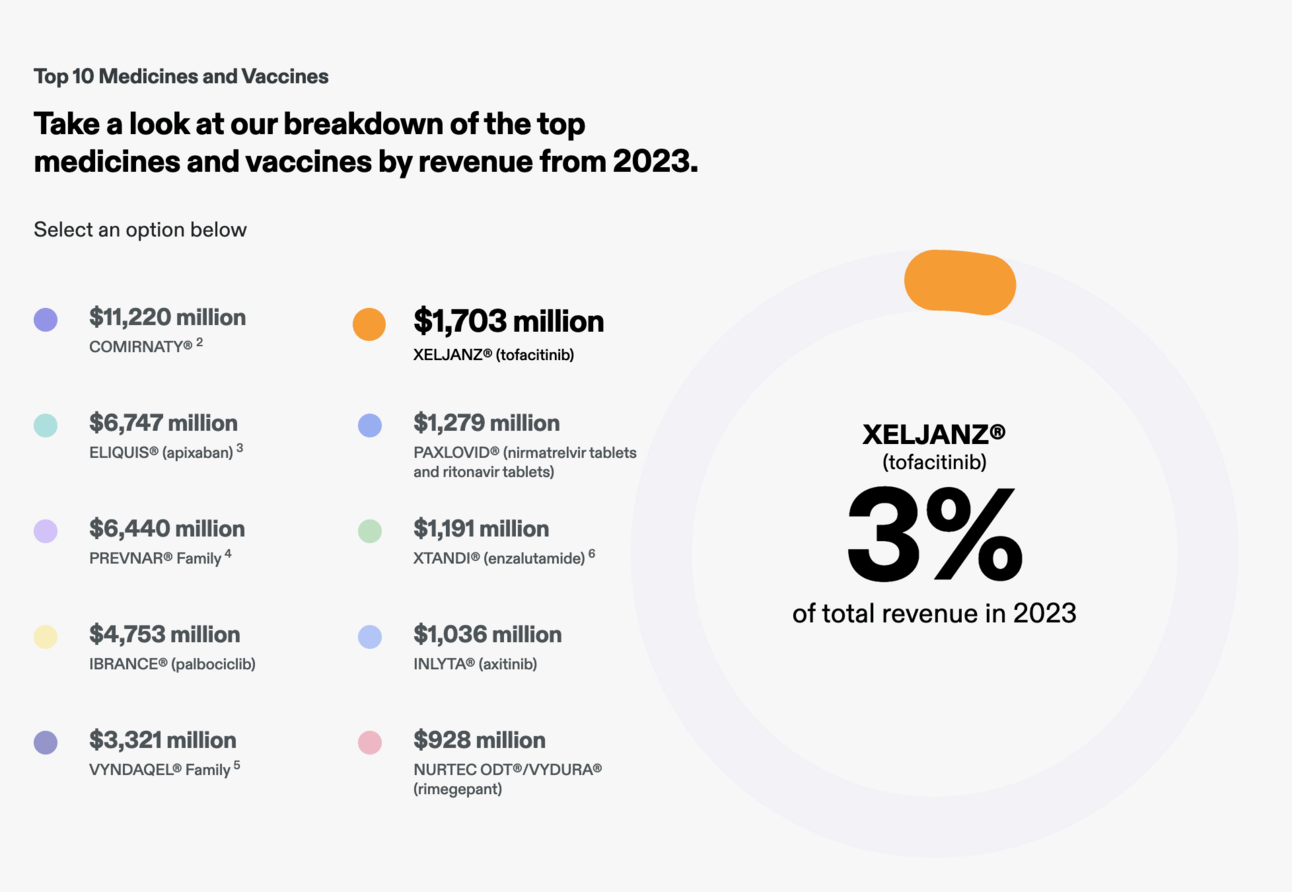

Pfizer's first-quarter earnings for 2024 presented a paradox of growth and decline. While key products continue to perform strongly, a notable 19% operational revenue decrease was recorded, primarily due to dwindling sales of COVID-19 products like Comirnaty and Paxlovid. Nevertheless, with total revenues hitting $14.9 billion and a net income of $3.11 billion, Pfizer's financial health remains robust, albeit with a 44% profit dip compared to last year.

Analyzing the Post-COVID Stock Slump

Post-pandemic, Pfizer’s stock took a nosedive, reaching a 10-year low in December. This downturn is largely attributed to the reduced demand for COVID-19 vaccines and treatments, with projected 2024 sales dropping from $12.5 billion to $8 billion. Investors recalibrated their expectations as the world anticipated the pandemic's end, impacting Pfizer's market valuation.

Understanding Shareholder Discontent

The investor dismay was sparked by Pfizer’s 2024 profit and revenue forecasts, which fell below analysts' expectations. This was compounded by a significant 8% share price drop in early trading sessions, marking a record low in over a decade. These developments reflect broader market sentiments about the scaling down of pandemic-era products.

Strategic Cost-Cutting Initiatives

In response to the subdued financial outlook, Pfizer has put into motion aggressive cost-cutting strategies aimed at saving $4 billion by year’s end. These cuts extend across various departments, with a significant portion expected from research and development efficiencies. This proactive approach is designed to bolster profitability amid revenue fluctuations.

CEO's Insight: The Undervalued Powerhouse

CEO Albert Bourla has publicly stated his belief in Pfizer's undervaluation, citing a strong pipeline and ongoing breakthroughs that could propel future growth. His optimism is a beacon for potential investors and stakeholders, suggesting a resilient bounce back from current challenges.

Pfizer’s Core Strengths and Promising Pipeline

At the heart of Pfizer's resilience is its diversified portfolio featuring leading drugs such as Prevnar 13, Ibrance, and Eliquis, and recent strategic acquisitions like Seagen, boosting its oncology suite. Pfizer's commitment to groundbreaking R&D remains unwavering, ensuring a continuous flow of innovative treatments that promise to redefine healthcare landscapes and fuel long-term growth.

The Road to Recovery: A Vision for the Future

Pfizer's prospects for recovery and growth look promising. With a strategic focus on core strengths and a dynamic approach to market challenges, Pfizer is poised to deliver significant returns. The next five years could see a total return exceeding 100%, driven by earnings growth and dividends, illustrating Pfizer's potential as a prudent long-term investment.

Conclusion

In the wake of the pandemic, Pfizer has shown remarkable adaptability and strategic foresight. The company’s journey is characterized by strategic adjustments, a strong commitment to innovation, and a clear vision for the future. As Pfizer continues to navigate post-pandemic realities, its blend of robust product offerings and forward-thinking initiatives position it as a compelling choice for investors. Looking ahead, Pfizer’s trajectory will be one to watch, as it continues to innovate and grow in a changing world.

Stay Ahead of AI Technologies and Stocks Investment – Subscribe Today!

Stay ahead in the dynamic world of AI technologies and stock investments by subscribing to our newsletter. We deliver the latest insights and trends in AI and the financial markets directly to your inbox. Keep informed about the revolutionary advancements and investment opportunities that are reshaping our digital and economic landscapes.

Looking forward to our next update,

AiartGallerie

Reply