- AiartGallerie(Invest)'s Newsletter

- Posts

- How Tesla's Top Supplier is Powering the Future

How Tesla's Top Supplier is Powering the Future

Imagine a company that has not only survived but thrived through the ups and downs of the global economy, adapting to changes with remarkable agility. Albemarle Corporation, a leader in the specialty chemicals industry, is one such company. Founded in 1887, Albemarle began as a paper manufacturing business and has since evolved into a global powerhouse in the production of lithium, bromine, and catalysts.

Albemarle's journey is a testament to strategic foresight and resilience. Over the decades, the company has shifted its focus to meet emerging market demands, most notably in the energy storage and electric vehicle (EV) sectors. This adaptability has been crucial in maintaining its competitive edge in an ever-changing industry landscape.

In the early 2000s, Albemarle made a significant pivot towards lithium production, recognizing the material's growing importance in rechargeable batteries. This strategic move positioned Albemarle at the forefront of the lithium revolution, supplying a key component for the burgeoning EV market. Today, Albemarle is one of the largest lithium producers globally, contributing to the transition towards cleaner energy solutions.

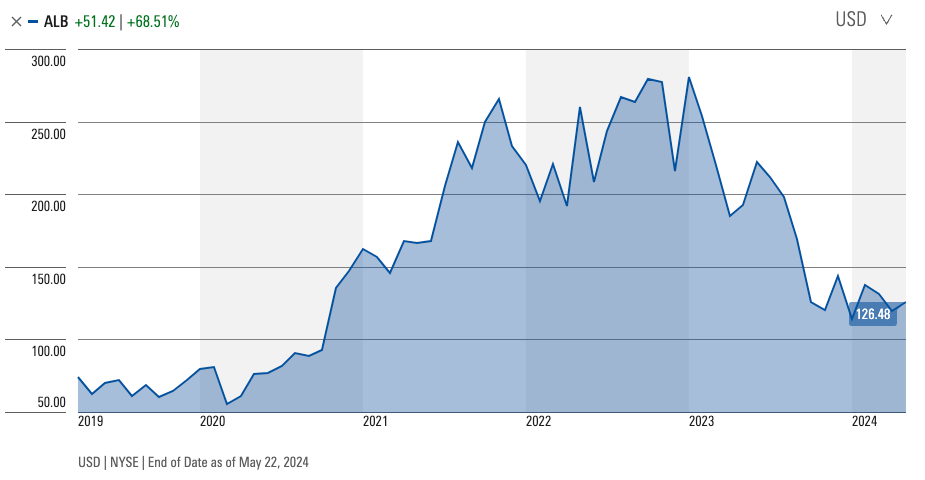

Yet, Albemarle's success hasn't been without challenges. The fluctuating prices of lithium and other commodities have tested the company's mettle. Despite these hurdles, Albemarle has consistently demonstrated financial robustness, ensuring steady growth and profitability.

Albemarle's diverse portfolio spans several high-growth areas within the specialty chemicals sector. The company operates three main segments: Lithium, Bromine Specialties, and Catalysts. Each segment plays a critical role in Albemarle's overall strategy, catering to different industries and markets.

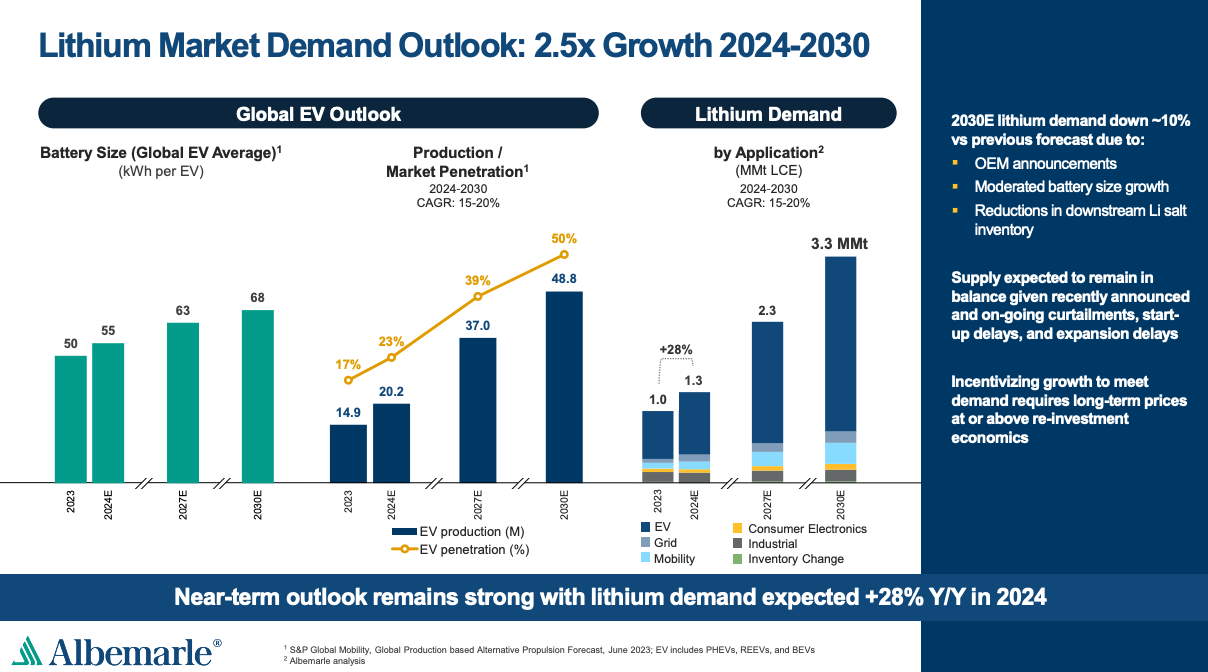

The Lithium segment is particularly noteworthy due to its alignment with the global shift towards renewable energy. Lithium is a crucial component in lithium-ion batteries, which are widely used in electric vehicles and portable electronics. As the demand for EVs continues to rise, so does the demand for lithium, positioning Albemarle as a key player in the energy storage market.

Bromine Specialties provide another steady revenue stream. Bromine is used in flame retardants, drilling fluids, and water treatment chemicals. Albemarle's operations in this segment benefit from stable market conditions and consistent demand, ensuring a balanced portfolio that can weather market volatility.

The Catalysts segment focuses on refining catalysts used in the petroleum industry. Despite the growing emphasis on renewable energy, fossil fuels remain a significant part of the global energy mix. Albemarle's catalysts help refineries produce cleaner fuels, aligning with regulatory trends towards reducing emissions.

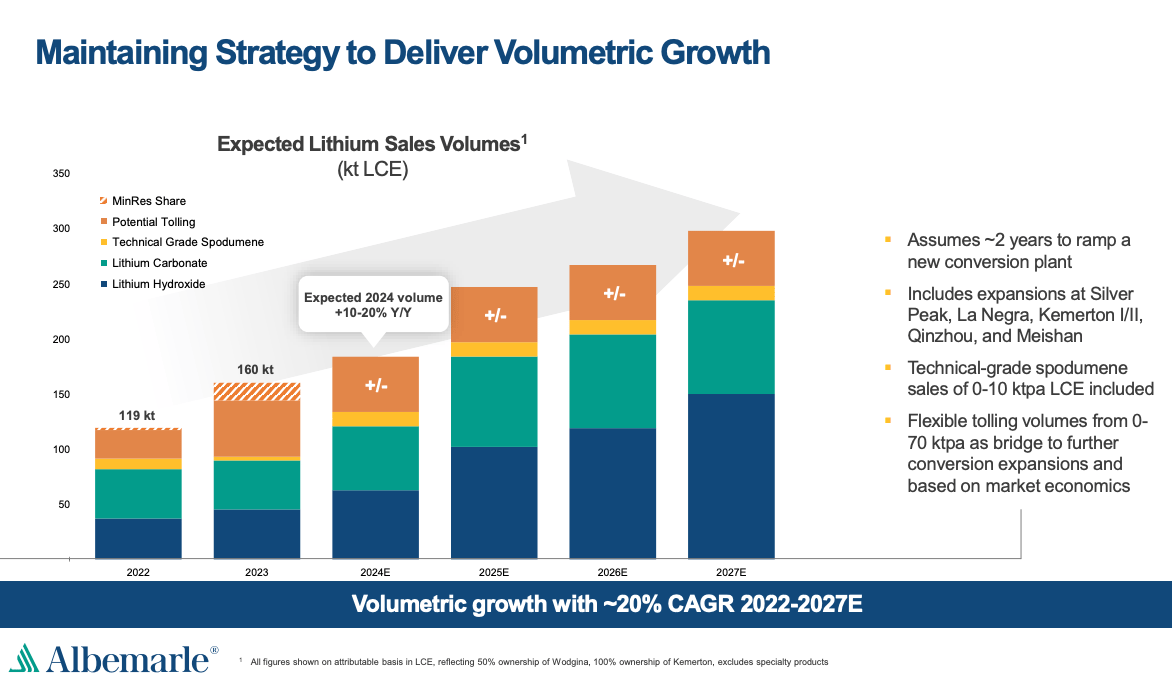

Albemarle's strategic investments in expanding lithium production capacity are a testament to its forward-looking approach. The company's decision to invest in new lithium extraction technologies and expand its production facilities aligns with the global push towards electrification and renewable energy. This proactive strategy ensures that Albemarle is well-positioned to meet the increasing demand for lithium in the coming years.

Screen Captured from Morningstar.com

Moat and Financial Strength

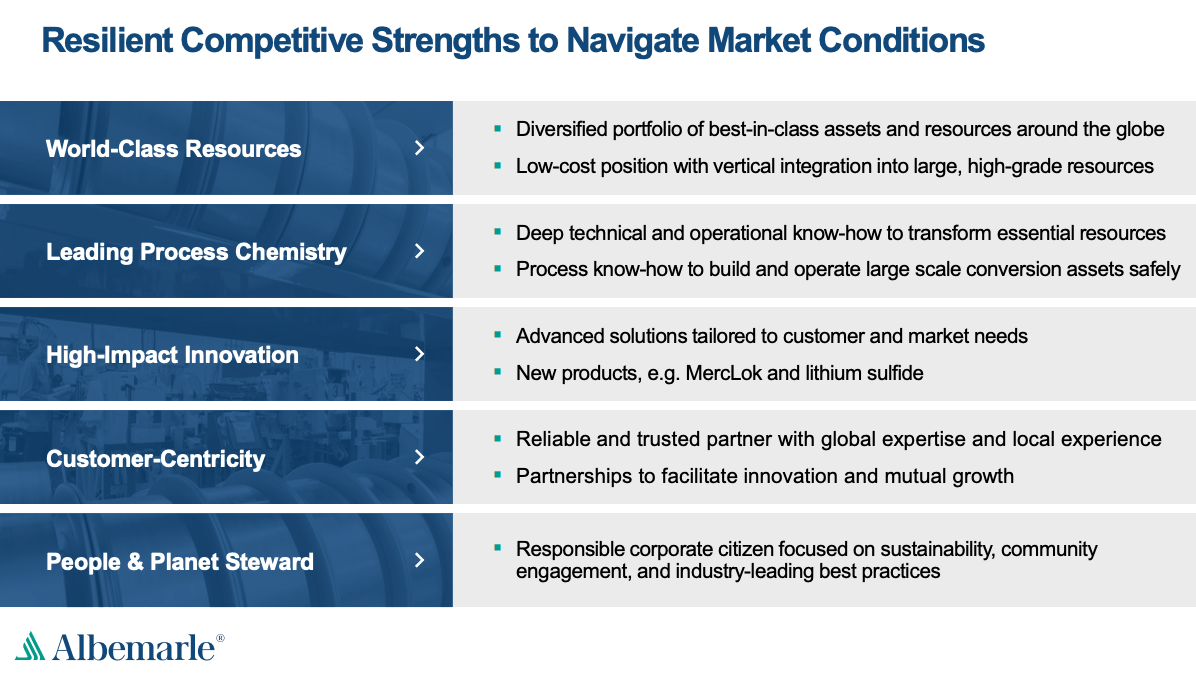

Moat: Albemarle's competitive moat lies in its diverse product portfolio and leading position in lithium production. The company's extensive experience and technological expertise in lithium extraction and processing provide a significant barrier to entry for competitors. Additionally, Albemarle's integrated operations, from mining to chemical processing, offer cost advantages and operational efficiencies that enhance its competitive edge.

Profit and Loss: Despite experiencing significant revenue fluctuations, Albemarle has maintained positive net income. In Q1 2024, the company's total net sales were $1.36 billion, a 47% decrease from Q1 2023. This decline was primarily due to a drop in the Energy Storage segment, which saw a 59% decrease in sales. However, Albemarle's ability to generate positive net income, albeit reduced from $1.24 billion in Q1 2023 to $2.45 million in Q1 2024, underscores its resilience and efficient cost management.

Balance Sheet: As of March 31, 2024, Albemarle's total assets stood at $19.03 billion, with substantial cash reserves of $2.06 billion. This strong liquidity position provides the company with the financial flexibility to navigate market volatility and invest in growth opportunities. The company's long-term debt is $3.52 billion, which, while substantial, is manageable given its robust asset base and revenue generation capabilities.

Cash Flow: Albemarle has consistently generated positive free cash flow, critical for long-term sustainability. In 2023, the free cash flow after tax was $9.57 billion, highlighting the company's strong operational cash generation. This financial strength enables Albemarle to reinvest in its core businesses and pursue strategic acquisitions, ensuring sustained growth and competitiveness.

Risks to Consider

Market Volatility: One of the primary risks Albemarle faces is market volatility, especially in commodity prices. The price of lithium, a key revenue driver, is subject to significant fluctuations based on market supply and demand dynamics. Such volatility can impact Albemarle's revenue and profitability, necessitating robust risk management strategies.

Regulatory Changes: Albemarle operates in a highly regulated industry. Changes in environmental regulations, trade policies, and other regulatory frameworks can affect operational costs and market access. The company must continually adapt to these changes to maintain compliance and mitigate associated risks.

Operational Risks: Large-scale mining operations pose inherent risks, including environmental impact and resource depletion. Albemarle's operations must adhere to stringent environmental standards to minimize ecological damage. Additionally, the company must manage the long-term sustainability of its resource base to ensure continued production capabilities.

Albemarle Corporation stands out as a resilient and forward-thinking leader in the specialty chemicals industry. Its strategic focus on lithium production, robust financial health, and diversified portfolio provide a strong foundation for sustained growth. Despite facing market volatility and regulatory challenges, Albemarle's ability to adapt and innovate positions it well for the future.

As the world transitions towards renewable energy and electrification, companies like Albemarle are crucial in shaping a sustainable future. Investors looking for long-term growth opportunities should consider the strategic importance and financial resilience of Albemarle.

Additional Notes: For those interested in exploring further, detailed financial statements and management discussions are available in Albemarle's latest annual reports. Keep an eye on industry trends and regulatory changes that could impact the company's operations and market position.

Stay Ahead of Stocks Investment Ideas and Knowledge – Subscribe Today!

Stay ahead in the dynamic world of stock investments! Subscribe now to our newsletter and get the latest insights and trends in the financial markets delivered straight to your inbox. Be informed about the revolutionary advancements and investment opportunities that are reshaping our digital and economic landscapes. Click here to subscribe - Your future self will thank you!

Looking forward to our next update,

AiartGallerie

Reply