- AiartGallerie(Invest)'s Newsletter

- Posts

- Why Investing in Adobe is a Game-Changer

Why Investing in Adobe is a Game-Changer

An Inspiring Journey: Adobe’s Rise to Prominence

In the dynamic world of technology, few companies have maintained a steady trajectory of innovation and growth like Adobe Inc. Born from a simple idea to revolutionize digital media and creativity, Adobe’s journey from a small startup to a global leader in creative software is nothing short of inspirational.

Founded in 1982 by John Warnock and Charles Geschke, Adobe began its journey with a breakthrough technology called PostScript, a revolutionary printing language. This innovation laid the foundation for Adobe’s future success, capturing the attention of tech giants like Apple, which integrated PostScript into its LaserWriter printers. This collaboration was the beginning of Adobe’s ascent in the tech industry.

As the digital age dawned, Adobe embraced the challenge of evolving with it. The introduction of Adobe Photoshop in 1988 marked a pivotal moment, transforming the way professionals and enthusiasts approached digital imaging. Photoshop’s success was not a stroke of luck but a testament to Adobe’s commitment to innovation and understanding market needs.

Adobe didn’t stop there. Recognizing the growing demand for digital document management, Adobe launched Acrobat and the PDF format in the early 1990s. This move revolutionized the way documents were shared and viewed, establishing Adobe as a key player in the software industry. The company’s ability to anticipate market trends and pivot accordingly has been a cornerstone of its enduring success.

The turn of the millennium saw Adobe expanding its portfolio with the acquisition of Macromedia, bringing popular products like Flash and Dreamweaver under its umbrella. This strategic move strengthened Adobe’s position in web development and multimedia software. However, it was the shift to a subscription-based model with Adobe Creative Cloud in 2012 that truly transformed the company. By offering its vast suite of creative tools as a service, Adobe ensured a steady revenue stream and greater accessibility for users worldwide.

Today, Adobe continues to push the boundaries of creativity and technology with its focus on artificial intelligence and machine learning. Adobe Sensei, the AI and machine learning framework, enhances the capabilities of its products, making them indispensable for creatives and businesses alike. Adobe’s journey is a testament to its relentless pursuit of innovation and its ability to adapt to the ever-changing tech landscape.

Company Background, Development, and Industry Knowledge

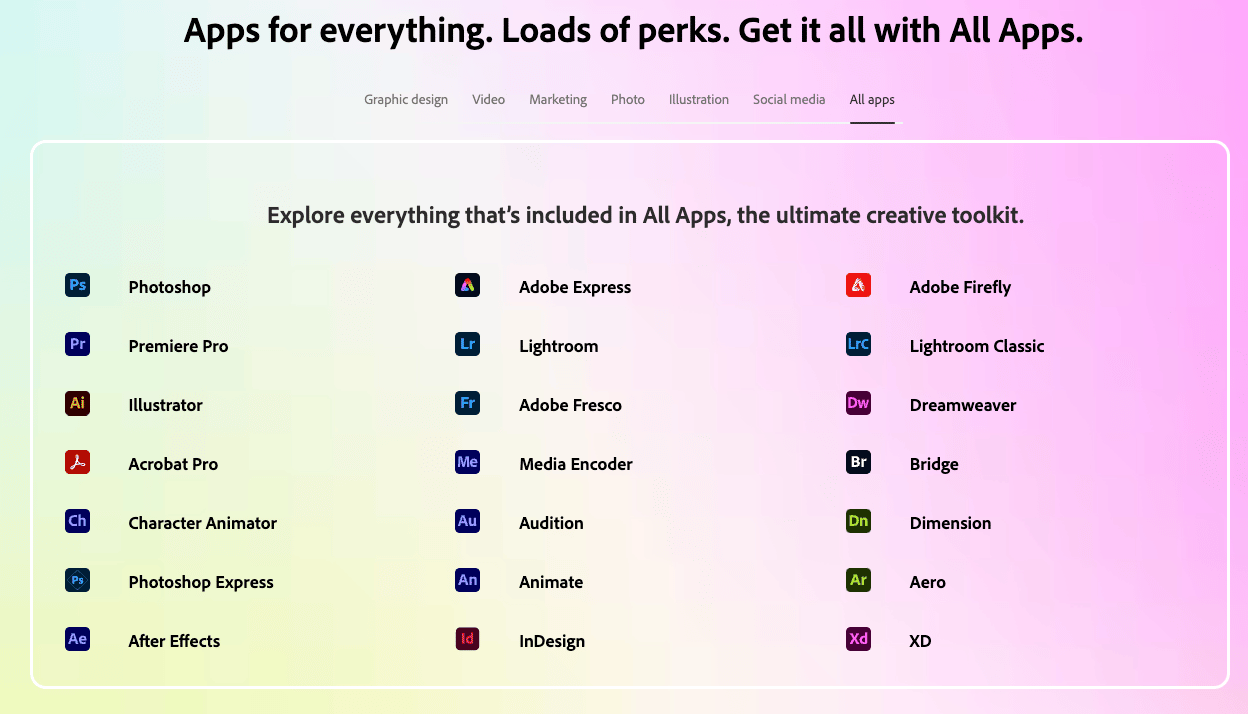

Adobe Inc. operates at the intersection of creativity and technology, with a diverse product portfolio that includes Creative Cloud, Document Cloud, and Experience Cloud. Each of these product lines caters to different aspects of digital media and business needs, making Adobe a versatile player in the software industry.

Creative Cloud, Adobe’s flagship offering, includes industry-standard applications such as Photoshop, Illustrator, and Premiere Pro. These tools have become essential for professionals in fields ranging from graphic design to video production. By continuously updating and adding new features, Adobe ensures that Creative Cloud remains relevant and valuable to its users.

Document Cloud, which includes Adobe Acrobat and Adobe Sign, addresses the growing need for digital document management and e-signature solutions. As businesses increasingly move towards paperless operations, Document Cloud provides secure and efficient tools for document creation, sharing, and signing. This segment has seen significant growth, especially during the COVID-19 pandemic, as remote work and digital workflows became the norm.

Experience Cloud offers a suite of tools for marketing, advertising, and analytics. This platform helps businesses deliver personalized customer experiences by leveraging data and insights. With the rise of digital marketing and e-commerce, Experience Cloud has become a critical component for companies looking to engage their audiences effectively.

Adobe’s commitment to innovation is evident in its investment in artificial intelligence and machine learning. Adobe Sensei, the AI framework, powers features across all Adobe products, enhancing capabilities such as image recognition, content personalization, and predictive analytics. This focus on AI not only improves user experience but also keeps Adobe at the forefront of technological advancements.

Unlock the secrets to tripling your profits with our comprehensive options trading course! 📈💰 Learn from the legendary strategies of Warren Buffett and master powerful techniques like bull put spreads, iron condors, and straddles. From understanding the basics of options to implementing advanced strategies, our course equips you with everything you need to turn small investments into significant gains. 🚀 Enroll now and discover how I transformed $2.3k into $27k in just one year! 🌟Learn More

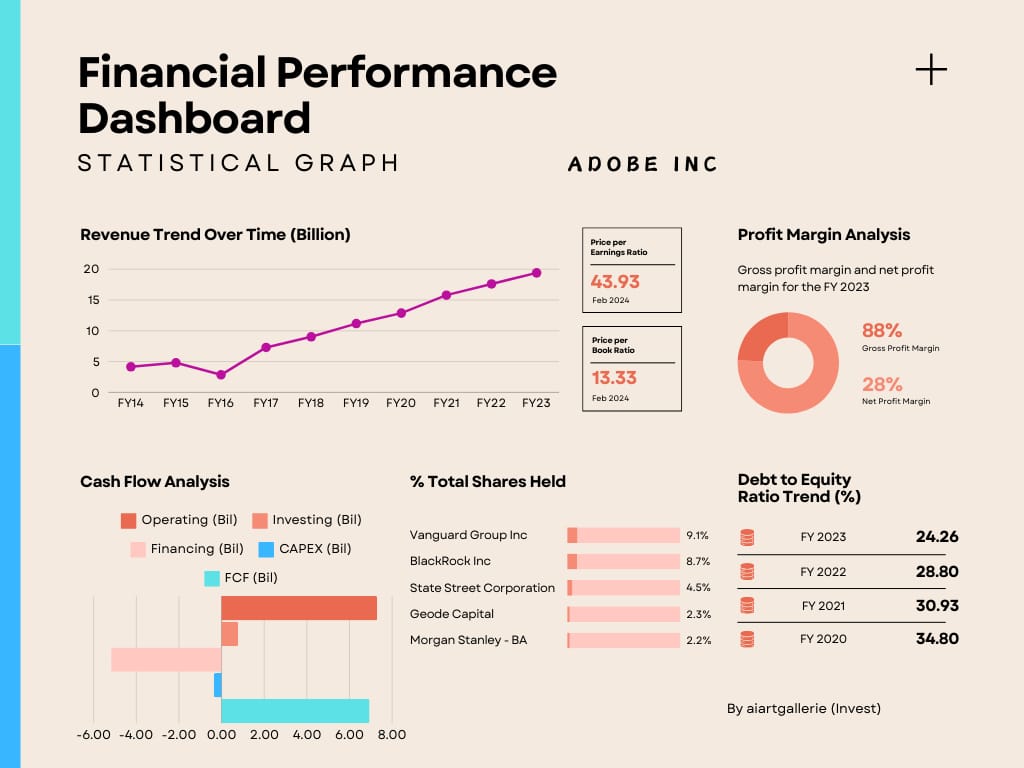

Financial Strength Analysis

Profit and Loss Statement

Adobe Inc.’s financial performance in the first quarter of 2024 showcases its resilience and growth potential. Key highlights from the profit and loss statement include:

• Revenue: Adobe’s total revenue increased to $5.182 billion in Q1 2024, up from $4.655 billion in Q1 2023. This growth was driven primarily by the expansion of subscription services, which underscores the success of its Creative Cloud and Document Cloud offerings.

• Gross Profit: The gross profit for Q1 2024 was $4.592 billion, compared to $4.087 billion in Q1 2023. Maintaining a high gross profit margin of 89%, Adobe continues to demonstrate strong operational efficiency.

• Operating Income: Operating income decreased to $907 million in Q1 2024 from $1.586 billion in Q1 2023. This decline was primarily due to a $1 billion acquisition termination fee, highlighting the financial impact of strategic decisions.

• Net Income: Net income for Q1 2024 was $620 million, down from $1.247 billion in Q1 2023. The decrease is largely attributed to the aforementioned termination fee, yet the underlying business remains strong.

Balance Sheet

Adobe’s balance sheet reflects a robust financial position:

• Total Assets: Total assets were $28.751 billion as of March 1, 2024, slightly down from $29.779 billion as of December 1, 2023. This minor reduction is manageable within the context of Adobe’s overall financial health.

• Cash and Cash Equivalents: Adobe held $6.254 billion in cash and cash equivalents, providing substantial liquidity and financial flexibility.

• Liabilities: Total liabilities were $13.291 billion, marginally up from $13.261 billion. This includes current liabilities of $9.537 billion and long-term liabilities of $3.754 billion, indicating a balanced approach to financial management.

• Stockholders’ Equity: Total stockholders’ equity was $15.460 billion, down from $16.518 billion, due to share repurchases and dividends. This demonstrates Adobe’s commitment to returning value to shareholders.

Cash Flow Statement

Adobe’s cash flow statement highlights its strong cash generation capabilities:

• Operating Activities: Net cash provided by operating activities was $1.174 billion in Q1 2024, down from $1.693 billion in Q1 2023. This decline reflects changes in working capital but remains robust.

• Investing Activities: Net cash provided by investing activities was $66 million in Q1 2024, compared to $156 million in Q1 2023. This reduction is linked to strategic investments and acquisitions.

• Financing Activities: Net cash used for financing activities was $2.128 billion in Q1 2024, up from $2.014 billion in Q1 2023, primarily due to increased share repurchases. This reflects Adobe’s confidence in its long-term growth prospects.

Competitive Advantages

Business Overview

Adobe’s competitive edge is rooted in its diversified and innovative product portfolio. The company’s offerings span creative software, digital document management, and customer experience solutions. By continuously evolving its products and integrating cutting-edge technologies like AI, Adobe remains indispensable to a wide range of customer segments, from individual creators to large enterprises.

Management’s Discussion and Analysis

Adobe’s management team emphasizes continuous innovation and market expansion as key drivers of growth. The company’s robust pipeline of new products and features, particularly in artificial intelligence, positions it well against competitors. Adobe’s strategic acquisitions and partnerships further bolster its market position and open new avenues for growth.

Management Efficiencies

Directors, Executive Officers, and Corporate Governance

Adobe’s leadership is widely recognized for its strategic vision and operational efficiency. Under the stewardship of CEO Shantanu Narayen, Adobe has navigated significant transformations, including the transition to a subscription-based model. This shift has stabilized revenue streams and improved profitability, demonstrating effective leadership and foresight.

Executive Compensation

Adobe’s executive compensation aligns management’s interests with those of shareholders. Performance-based incentives ensure that executives are motivated to drive long-term growth and value creation, fostering a culture of accountability and excellence.

Screen Captured from Morningstar.com

Major Risks

Risk Factors

Despite its strengths, Adobe faces several risks that investors should consider:

• Market Competition: Adobe operates in a highly competitive industry, with intense competition from other software providers and new market entrants. This competition could impact Adobe’s market share and pricing power.

• Technological Changes: Rapid technological advancements necessitate continuous innovation. Failure to keep pace with these changes could affect Adobe’s competitive position and market relevance.

• Regulatory Risks: Changes in regulations, particularly around data privacy and cybersecurity, could impose additional costs and operational challenges. Compliance with evolving regulatory requirements is crucial for maintaining trust and avoiding legal repercussions.

Unlock the secrets to tripling your profits with our comprehensive options trading course! 📈💰 Learn from the legendary strategies of Warren Buffett and master powerful techniques like bull put spreads, iron condors, and straddles. From understanding the basics of options to implementing advanced strategies, our course equips you with everything you need to turn small investments into significant gains. 🚀 Enroll now and discover how I transformed $2.3k into $27k in just one year! 🌟Learn More

Conclusion

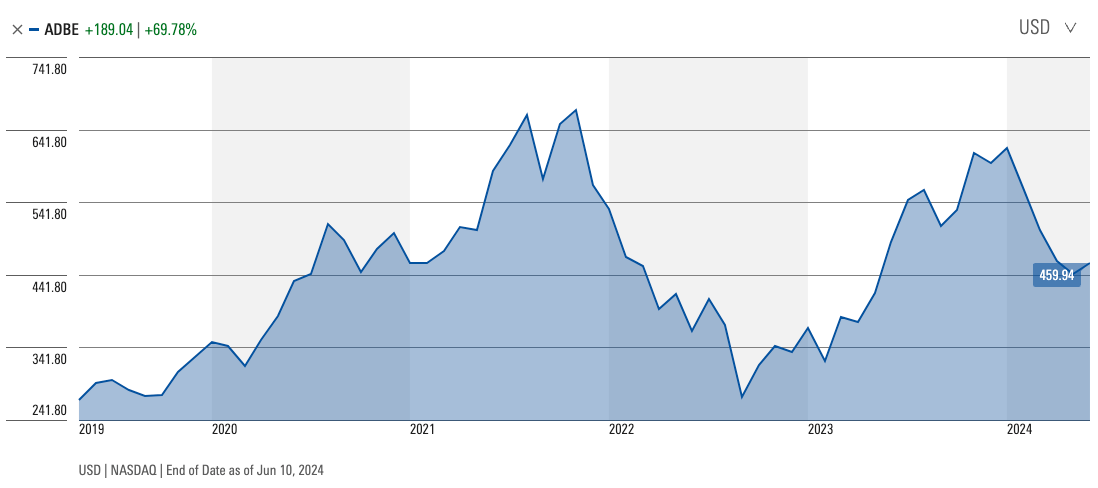

Summary

Adobe Inc. stands out as a robust investment opportunity, boasting strong financial health, high profitability, and a solid balance sheet. The company’s commitment to innovation, particularly in AI and cloud services, underpins its competitive advantages. Effective management and governance structures further bolster its long-term prospects.

Final Thought

Investing in Adobe is about trusting in its consistent ability to innovate and deliver value over the long term. As the digital landscape continues to evolve, Adobe’s strategic vision and operational excellence position it well to capitalize on emerging opportunities and navigate potential challenges.

Additional Notes

For those considering an investment in Adobe, understanding the company’s strategic initiatives and financial health is crucial. By staying informed about Adobe’s market position, competitive landscape, and potential risks, investors can make well-informed decisions. As always, diversifying your portfolio and consulting with financial advisors can help manage risks and optimize returns.

For more insights and detailed analysis, refer to the attachments:

Stay Ahead of Stocks Investment Ideas and Knowledge – Subscribe Today!

Stay ahead in the dynamic world of stock investments! Subscribe now to our newsletter and get the latest insights and trends in the financial markets delivered straight to your inbox. Be informed about the revolutionary advancements and investment opportunities that are reshaping our digital and economic landscapes. Click here to subscribe - Your future self will thank you!

Looking forward to our next update,

AiartGallerie

Reply